Every now and then, keeping up with your finances is a struggle for small businesses—especially with their financial statements. Building a business, training employees, and trying to provide for your family are enough on your plate. Now that your business finances are worrying you, you’re not sure where to even start looking for help.

Whether it is the pandemic or something else that is causing financial turmoil to your small business, you don’t need to drown. Now is the time to join other small business owners in collaborating with their accounting firms. And now is the time that it is even more important to be working with a CPA that helps you access the loans that can keep your small business above water and thriving.

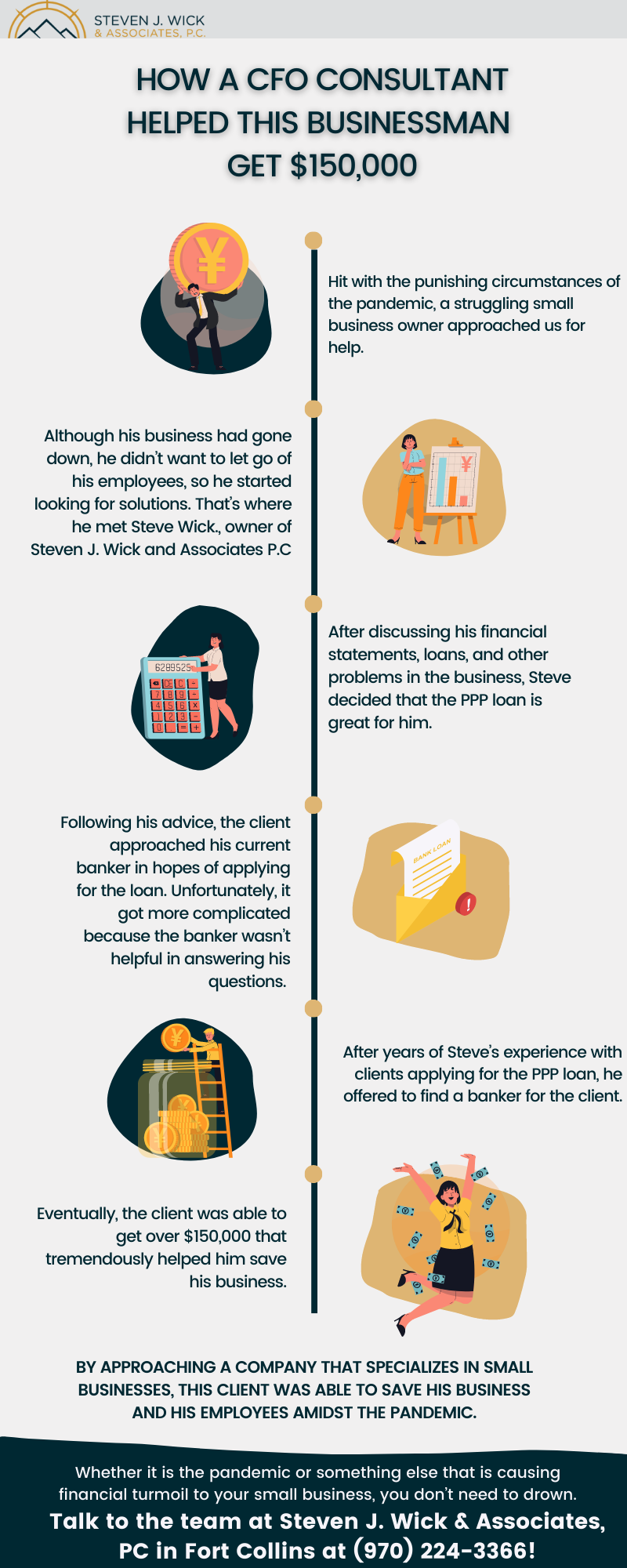

Client Story: A Small Business Owner That Needed Financial Help During COVID-19

When COVID-19 happened in 2020, a lot of industries had taken a hit. This is what happened to our client, a manufacturer in Fort Collins, who was struggling financially. Although his business had gone down, he didn’t want to let go of his employees, so he started looking for solutions. That’s where he met Steve Wick.

Applying for The Right Financial Help for Your Small Business Through Our Expert CPAs

Steve, the principal owner of Steven J. Wick and Associates P.C, had a meeting with the client to discuss their financial statements on a monthly basis, their problems in the business, and the loans they needed to pay off.

After a series of meetings, Steve decided that the PPP loan is great for him. Following his advice, the client approached his current banker in hopes of applying for the loan. Unfortunately, it got more complicated because the banker wasn’t helpful in answering his questions. Leaving him feeling discouraged to pursue the application.

After years of Steve’s experience with clients applying for the PPP loan, he offered to find a banker for the client. Eventually, the client was able to get over $150,000 which tremendously helped him save his business.

In approaching a company that specializes in small businesses, this client was able to save his business and his employees amidst the punishing circumstances of the pandemic.

The Right Program and Package for Your Small Business

As small businesses try to survive and make it work in these current times, getting the right help from good accounting firms is a win in itself. It will not only transform your business, but it will also get you focused on your proper financing practices and improve business management.

For more than 20 years, Steven J. Wick and Associates P.C. has been a trusted name in Fort Collins, Colorado when it comes to small business owners hiring CPAs to help them grow their small businesses.

Our expertise and services include (but aren’t limited to):

- General bookkeeping and record-keeping services

- Tax advise and preparation services

- Payroll management and administration

- Account reconciliation services

- Financial statement preparation

We can help you use existing software (like QuickBooks), and help you get accurate data to help develop strategies and goals based on your small business’ finances.

CFO Consulting For Your Small Business in Fort Collins

Accounting firms are essential when you want your small business to grow and develop over time, especially in these times of crisis, and they can also help you get initial funding for expansion. Accounting services involve the identification, measurement, and recording of financial transactions of a business. Thus, the output of the accounting service will be useful for business owners to make decisions for their businesses.

An exceptional CPA should not only get you the financial help your small business needs but also consult with you on how to grow your business. Moreover, your business’s finances play an important part in the management of your business. It is tough, however, for untrained people to work on this connection. This is where the outsourced Chief Financial Officers come in.

CFOs are the ones who help the management create operational and financial policies. They often make their decisions using the company’s financial statements. If you’re a small business owner operating in Fort Collins, Colorado, and are looking for an affordable outsourced CFO service, our professional accountants or CFOs can help you improve your current operations and productivity by digging deep into your business finances. We provide practical financial advice to make your business stronger and more efficient.

Do you need financial help for your small business in Fort Collins? We got you!

Running a business is never easy. It’s not a 9-5 job either and you have to work long, hard, and smart.

Learning new things and getting help should be a conscious decision you’ll always have to make to grow and expand your business. By hiring an accountant, you’ll have professional eyes to save your business during financial hardships, and help set it up for future growth no matter the circumstances.

To leverage your time and skills, you must invest in hiring a trusted accounting service company that wants and strives to help you succeed. Steven J. Wick and Associates P.C.’s purpose is to transform business owners into highly effective managers, leaders, and entrepreneurs and to help grow and expand your business.

To get financial help for your small business, don’t hesitate to consult and talk to one of our accountants at Steven J. Wick & Associates, PC in Fort Collins, Colorado!