Can you be an efficient entrepreneur while doing proper bookkeeping for your small business near Denver at the same time? Competition can be tough and demanding and it’s important to give your business the attention it needs. But bookkeeping can take much of your valuable time.

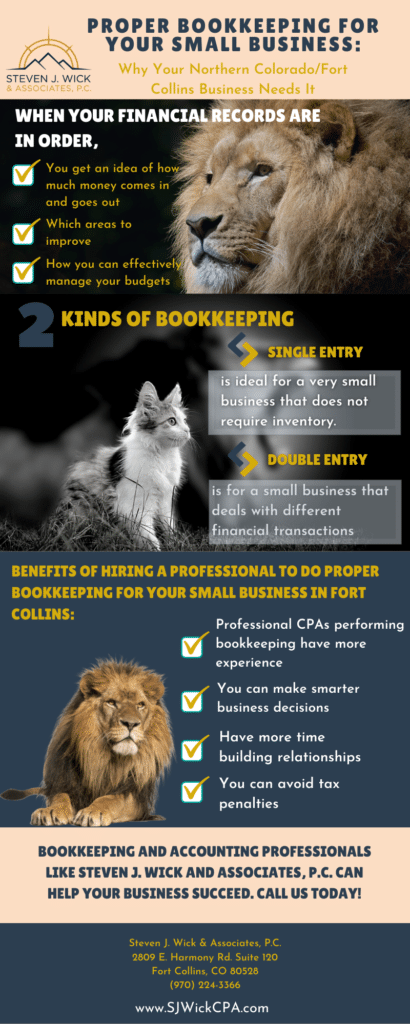

You can’t be lax with bookkeeping. It’s a dilemma, but when your financial records are in order, you get an idea of how much money comes in and goes out, which areas to improve, and how you can effectively manage your budgets.

Many small business owners are reluctant to hire a professional CPA or accountant in Northern Colorado, thinking start-ups need to make more and spend less. Often, they get the impression that all they need is bookkeeping and that it is a simple task they can do on their own. And true enough, the job is straightforward, until it starts to weigh down on your routine and schedule.

If you are serious about growing your business, you may need to reconsider. Does your small business really need proper bookkeeping and accounting? Can it survive with standard daily documentation or accounting software like Quickbooks? The answer depends on how much you value your business and how eager you want to succeed.

How to Start Keeping Books for a Small Business the Proper Way

Proper bookkeeping for your small businesses means more than balancing all financial transactions of the company. It is a process that often starts with opening a bank account. What follows is the cut-and-dry process of organizing the cash flow, depending on which way you go bookkeeping-wise: single-entry or double-entry.

Single-entry is ideal for a very small business, meaning one that does not require inventory and doesn’t involve multiple cash transactions. It’s as simple as recording the money that comes in every day and getting the sum.

Double-entry bookkeeping is more complex. For a small business that deals with different financial transactions, uses equipment, and has an office, this may be the best route. With this, you will have to record both the credits and debits.

Determining the most convenient bookkeeping system

After registering your business and opening accounts in the Denver area (or Northern Colorado), the next thing to learn is how to start keeping books for a small business. Proper bookkeeping for a small business involves determining the best method to use as it can go beyond mere documentation.

Using freeware

For a start-up, maintaining a spreadsheet is the best way to go. Here, you use simple software like Excel or Google Sheets. Make sure you know how to operate these two as you would have to use formatting and formulas in the process.

Premium software

Desktop apps like Quickbooks, Xero, and Wave are popular among bookkeepers and accountants. Using these saves you from the time-consuming task of computing as they are programmed to do this. Remember that with these apps, what you input is all the information you can get. They do not provide comprehensive insights and analysis of your business trends.

Level up! Hire a CPA or accountant instead of just a “bookkeeper”

You may be excited about your business’ progress but the amount of work it takes to track your finances may leave you less enthusiastic about the bookkeeping process. You can simply leave all these to a professional bookkeeper or level up and get a certified accountant to be your right-hand man. An accountant will not only take down notes but also give you direction and help you grow your business.

Start recording each financial transaction

Once you have picked the best bookkeeping method, you can begin with the documentation. Accuracy is important in bookkeeping. Make sure that all information is entered into your spreadsheet correctly and under the right column.

Keep your books balanced

Balancing the books happens quarterly or yearly, depending on how often you want to track them. At the end of this period, the totals of debits and credits should match. Any discrepancies could bring you back to square one so tallying should be done thoroughly.

Accomplish the financial reports

The next step after balancing your books is preparing the financial reports. This involves organizing all the data and evaluating them. Look into the numbers and examine what they mean for your business. From the sum totals of your cash flow, you should be able to determine your company’s financial health and make important business decisions based on them.

Proper Bookkeeping for Your Small Business near Denver—Should You Do It On Your Own?

As tempting as it may be to do your own bookkeeping and ‘save a few bucks’, it could end up costing you in the long run. It could also help develop your numbers skills while ‘winging it’. That would work if your intention is to just collect and spend, making a steady monthly profit.

When the tasks start to pile up, and you find yourself unable to focus on critical business matters, it can become costly and tedious. It could be even worse if errors are found in your work and you must do the work all over again!

After this, you still have to understand what the numbers say. Other business matters shouldn’t be compromised because the bookkeeping part needs more attention.

If your goal is to grow your business, ask yourself: “Can and should I do it alone?” Hiring a professional to do proper bookkeeping for your small business (whether in Denver or Fort Collins) will save you money–as they will look for ways to save you money! It pays to hire a professional.

If you are still thinking twice about hiring a professional bookkeeper or an accountant, consider these benefits:

Professional CPAs that perform bookkeeping have more experience than you

Professional CPAs (especially in Northern Colorado, Denver, and/or Fort Collins) who perform bookkeeping should have mastery of numbers. They already know proper bookkeeping for a small business, including the easiest and most comprehensive methods. They will be responsible for tracking all your financial transactions, leaving you more time to focus on growing your business. While you take care of important matters, your bookkeeper can just send you a report at the end of the day or the week.

You can make smarter business decisions

Proper bookkeeping for a small business gives you more time to reflect on your business’s strengths and weaknesses. This will allow you to make wise decisions on where your business is going. This time, you can really take charge of your business and manage it full-time.

Have more time building relationships

Patricia Fripp, an expert in business communications once said: “You don’t close a sale; you open a relationship if you want to build a long-term enterprise.” This holds true for many successful entrepreneurs throughout the ages. Can you be one of them if most of your time is spent on sorting invoices and adding sales? No. As mentioned, bookkeeping is time-consuming. Rather than talking to people, you may end up talking to yourself alone while figuring out what your books say or reconciling the numbers.

A bookkeeper can quickly take care of your pile of invoices and checks, while you are out there building rapport with customers, suppliers, and partners, among others. If you hire a professional CPA though, you don’t only get to build it; you also get to nourish these business relationships. And this will take your Denver or Northern Colorado business to the next level.

You can avoid penalties, especially tax

Without proper bookkeeping for a small business, you risk delaying your tax payments, which leads to incurring penalties. This is a likely scenario if you are overloaded with bookkeeping duties and business management. You tend to forget about some of your financial responsibilities like taxes.

With a bookkeeper providing you with a comprehensive financial report, you are up to date with your finances and won’t miss any deadlines.

Is there a Difference? Proper Bookkeeping for a Large Business near Denver or Northern Colorado

Small and large businesses in the Denver area (or in any part of Northern Colorado) all aim for success, but it doesn’t mean their bookkeeping needs are the same. While the bookkeeping methods are similar, proper bookkeeping for a small business is simpler and for a large one, more complex.

Large businesses enter into more financial transactions, bigger inventory, more equipment, larger payrolls, and greater tax payments. They have to maintain several books at the same time and record more data. They may need a team of bookkeepers and accountants to handle huge amounts of financial data. Steven J. Wick and Associates, P.C. specializes in helping small businesses around Fort Collins with their bookkeeping and accountancy needs. For large businesses, we recommend finding and working with a CPA that has multiple individuals on a dedicated team for your business.

But remember that if you run a small business, the size of the business doesn’t mean that you have less need for reaching your goals. If you are aiming high, your workload could be just as heavy as a large business owner. At some point, both would find themselves on the same playing field.

Would a Bookkeeper Be Enough?

Bookkeepers play a key role in your small business’ success. However, their expertise is often limited to data management. Taxation, for instance, is better understood and accomplished by a certified accountant. If you want the whole package, you may need an accountant.

Proper Accounting vs Proper Bookkeeping for a Small Business?

Summing it up, bookkeepers can help you with numbers and they can only go as far as giving you basic insights into the cash flow. Proper bookkeeping for your small business in Denver and Northern Colorado involves working with an actual CPA or accountant. If your goal is to grow your business and generate huge profits, CPAs are the right people to work with.

An accountant can explain the hows and why’s of your financial record and create a game plan for further growth. They are experts in understanding profits, losses, equities, assets, and liabilities. Through analysis also, your accountant can help you pinpoint the weak and strong areas, implement efficient budgeting, regulate expenses, and find opportunities for your business growth.

Even small business also pays taxes, with which an accountant can help you a lot. Accountants oversee tax payments and collections. They are familiar with the policies and penalties, which will help you avoid a huge cut on your profits.

Bookkeeping and Accounting Professionals Can Help Your Business Succeed

Proper bookkeeping for a small business is not a walk in the park. Northern Colorado is home to a number of small and big businesses. Your business will have the potential to keep up with it if you get all your finances in order and nourish your business relationships at the same time. You may want to reassess your business goals and decide whether you want to manage your books without help. It may be an additional expense on your part, but the amount of time you can gain will make this venture worth it.

Hire a professional CPA and a bookkeeper to assist you with the tedious job of data management AND maximize your time, get expert advice, and find more opportunities for growth.

We can help! Steven J. Wick and Associates, P.C. provides professional bookkeeping and accounting services to small businesses that want constant growth. Our expert accountants here in Fort Collins are industry experts with long years of experience and a proven track record. Let us take the burden of accounting and bookkeeping off your shoulders so you can focus on your business.

Steven J. Wick and Associates, P.C. also offers business consulting, CFO, tax, payroll services, and Quickbooks accounting for all of Northern Colorado. Give us a call and let’s talk about how we can help you succeed!