Accounting for Dentist

But with a dental CPA, you don’t have to do your dental practice’s financial planning. You get years of expertise and help. We’re not going to lie to you—you do have to follow through and execute on the goals and actions set.

Here is the reality: whether you’re looking to start your own dental practice or building your company with multiple dentists, the path to a successful dental practice is paved with critical financial considerations and strategic agreements. Various costs such as your operational expenses, staffing costs, and professional fees, are enough to give anyone a headache.

In this article, you’ll learn about those financial costs in starting your dental practice and financial planning, and why getting dental CPA services near you are essential for your business!

Dental Practice Business Structure Matters: Who Is On Payroll

Dental Practice Business Structure Matters: Who Is On Payroll

In a dental practice, various team members contribute to the overall functioning (and cost) of the business. Your staff, partners, receptionists, dental hygienists, social media and all are roles that significantly impact your accounting processes. A dental practice may hire hygienists, dentists, and other employees as W-2 employees, or hire doctors and nurses contractually.

Some dental practices may run off a single dentist as the owner with staff that do the administrative work, while larger practices may have several owners involved. You may even be in a practice where you are the owner and other dentists have joined your practice as employees, rather than owners.

Regardless of how many members you have or how many people own the business, understanding the roles of each team member is essential for maintaining financial health and profitability in a dental practice.

Each of these people’s cash flow, contributions to overhead, insurance they take, procedures or tasks they perform, their benefits within payroll, and etc. matters!

That’s why an experience dental CPA may even help provide recommendations for the best route for setting up your dental practice and where to share costs or keep individuals in an employee setting—rather than just ‘so-and-so is costing you a lot, can you let them go’. Because payroll can be one of a dental practice’s financial planning & a dental business’ aspects that is not looked at correctly or creatively.

Understanding Costs in Your Dental Practice According to a Dental CPA

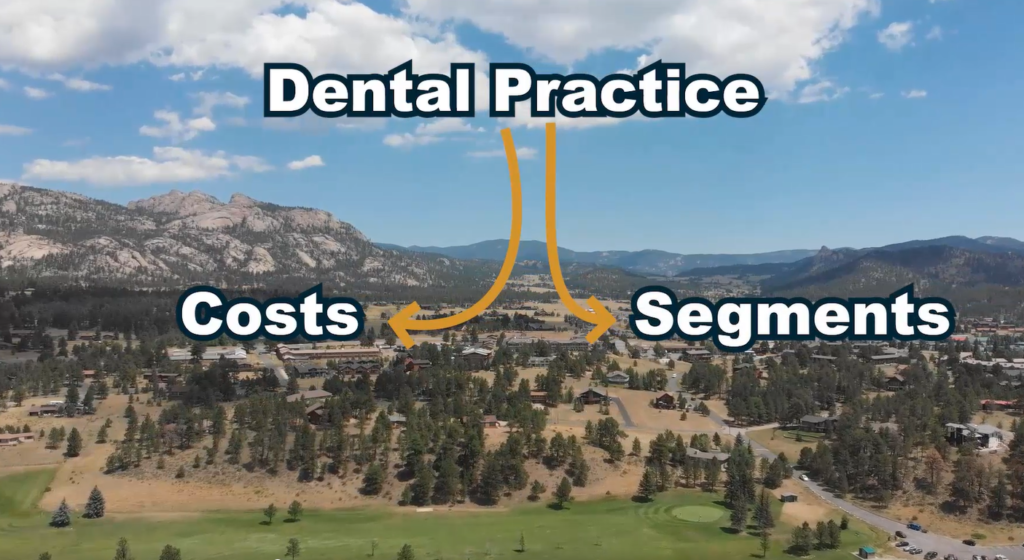

Now that we’ve broken down examples of a dental practice business structure, it’s time to delve into how the costs of each member in your dental practice contribute to your business’ financial health. There are costs outside of payroll (as discussed). Each of those types of costs are called segments.

As Steven J. Wick, a Fort Collins dental CPA, says “Business people understand they’re making money, but they don’t understand where their segments are.” In other words, while you may be aware that your business is making profit, it’s much more valuable to understand which components of your business are driving that profitability. And, of course, which ones are driving a loss.

How much are you charging for your services? How much are you paying your employees? What about insurance paperwork?

Yes, insurance paperwork is part of your dental practice’s financial planning. Let’s breakdown some of the factors in the cost of starting and running a dental practice.

Factors that Impact the Cost of Starting and Operating a Dental Practice

To help you understand the various factors that impact starting, operating and managing a dental practice’s financial plan, we walk through a few examples below:

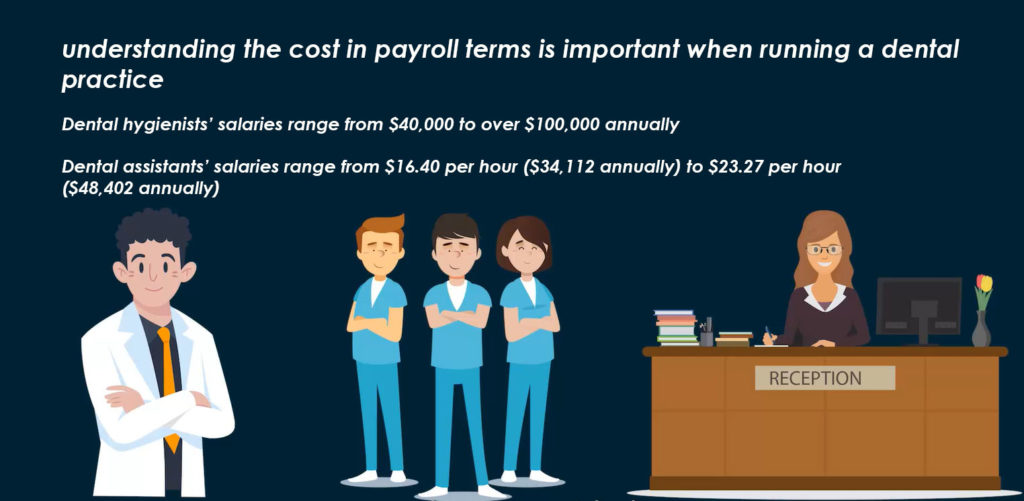

Payroll: The Necessary Expense of Delegation and Staff

We discussed some of the needs and costs with payroll when we discussed the structure of your business. When establishing a dental practice, assembling a competent team is essential. You will be hiring a lot of people with different skill sets offering various services, so understanding their cost in payroll terms (including details such as benefits) is important.

For example:

- Dental hygienists’ salaries vary significantly, ranging from $40,000 to over $100,000 annually, depending on the location of your practice, as reported by DentalPost. While,

- Dental assistants’ salaries range from $16.40 per hour ($34,112 annually) to $23.27 per hour ($48,402 annually), based on information from Indeed.

Now these are just a few examples without benefits or taxes, so what happens when you account for that too? What if you need to hire more people? This is where dental CPA services come in. Having a professional dental CPA near you to deal with the finances, you can rest assured they know how to root out problems and fill in the gaps you’re missing.

We often see payroll become the snowball of cost that gains traction to start quickly eating away at costs. If you are not watching it, projecting it, and working it into your dental practice’s financial planning—you’re essentially driving blind.

Overhead Expenses

Another cost you need to consider is the rent or mortgage payments for the office space, utilities, insurance premiums, and equipment maintenance costs. Additionally, investments in technology and dental equipment, such as X-ray machines, dental chairs, and sterilization tools, incur substantial upfront and ongoing expenses.

Overhead is not always a predicted, consistent cost from month to month (although this may be one of the more consistent costs after payroll). So, preparing for inflation and rising costs in the future is not only smart, but necessary to a long-term dental practice financial plan.

Supply and Material Costs

Supply and material costs are one of the first things we think of when we think of business costs. Although obvious, it is important in determining your dental practice’s overall cost structure.

You may be thinking ‘yes, just order another xyz’ when the cost of said item has increased, or your inventory isn’t properly calculated to show you do not need that item. These little (and sometimes big) costs add up over time.

From dental consumables like gloves, masks, and sterilization supplies to restorative materials and prosthetics, managing inventory and controlling costs are essential to maintaining your profitability.

Now we would never say ‘hey, you should go against hygiene practices’, or ‘you need to cheap out on xyz’—but a good dental CPA that cares about your dental practice’s financial planning is going to point out where your highest costs are and let you work with that.

Software: Yes, You Will Need Software

What you may not have thought of as a supply and materials cost is software. Software ranging from keeping dental patient records, to software for scheduling, to software for performing or interpreting procedures correctly is all a part of your business’ costs.

And although these costs may stay similar for long, they can grow exponentially when expanding. This may be a necessary growing pain if you plan to scale and grow your dental practice as part of your financial planning long-term.

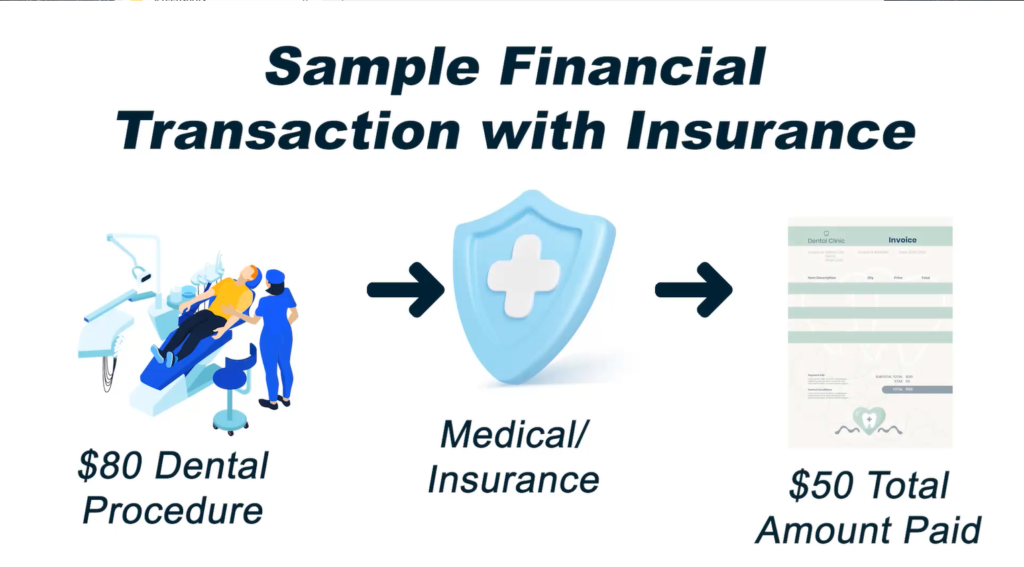

Insurance.. But Also, Everything Connected to Insurance Including Your Time

A dental CPA would also account not only for your business’ insurance, but also your financial transactions with insurance. Say you are doing a dental procedure that charges $80, but with insurance it would cost $50, it’s critical to understand how you are making money partnering with insurance companies. Getting down to the specifics is valuable for effective management of risks for your dental practice.

Insurance Is About More than Payout Per Procedure

Insurance is tricky because coverage is complicated. The cost of insurance isn’t just how much you get from insurance as a pay out; it also includes time doing paperwork, the model you want to run (volume vs type of procedure), the procedures you have the skillset to execute on, the number of patients you can accept under a specific insurance, and other details.

If multiple dentists accept different insurances, their incomes and what they can contribute will differ and fluctuate. That can make financial modeling trickier because it isn’t a straight one for one prediction.

The cost of filling out paperwork and requirements to be approved for an insurance are about time and money. The time associated with it alone can be a consideration on if you are really making the best profit or not with certain insurances or procedures. See the interconnectedness of these things within your dental practice’s financial planning? They depend on each other.

And honestly, sometimes you just need a third-party to look at the time, costs, and profit from insurance to say “hey, this won’t

Identifying Profitable Areas and Cost Centers of Your Dental Practice

Steve Wick, a dental CPA in Fort Collins, CO, shares a few guide questions to help you assess your dental practice’s financial planning and current financial health:

- Where’s your business at in financial standing?

- How much are you making from your dental services?

- How much time do you spend on each dental procedure?

- What other secondary dental services do you offer?

- What is your edge among other dental services in your area?

- How much cost or profit can insurance do to your business?

What a Dental CPA Can Do for Your Dental Practice’s Financial Planning and Current Business

A dental CPA is your right-hand person in the business. Adding to traditional accounting services, a dental CPA can also offer invaluable guidance on practice management and strategic financial decision-making.

A dental CPA in your business would understand the complexities of dental industry regulations, compliance requirements, and tax laws, helping you navigate these intricacies efficiently. By conducting in-depth financial analysis and benchmarking against industry standards, a dental CPA can identify your areas of improvement, optimize your revenue streams, and enhance profitability.

In short, a dental CPA would help you achieve your financial business goals for your dental practice. All done with experienced analysis, personalized strategy, and accountability follow through on what you need to execute on.

Choose Steven J. Wick & Associates, P.C. For Your Dental Practice’s Financial Planning– Near Fort Collins, CO

If you run a dental practice, you’ll need a dental CPA near you that understands and goes beyond traditional accounting structures. And you’ll want a dental CPA that is near you. You can find that with Steven J. Wick & Associates P.C! We provide customized accounting solutions and experienced dental practice financial planning specific to your dental business. Call us for an appointment or visit our website for more information on our available business solutions.