Restaurant Accounting

New and seasoned restaurateurs know just how hard balancing the books can be with limited time, accounting knowledge, and personnel. When the going gets tough, the survival of your restaurant business will depend on restaurant accounting services in Fort Collins.

Restaurant Accounting Services: The Basics You Need to Know

Many entrepreneurs dive into the restaurant business because food is a necessity, and therefore a lucrative venture. With that said, competition is tough, and as early as the planning stage, you may find yourself struggling for new ideas that can lead to profits and success, as well as satisfied patrons.

Product and marketing are only two of the common issues any restaurant business owner would face. Accounting is another level. While running a restaurant is a challenging yet fulfilling business venture, the accounting issues are off-putting.

What Restaurant Accountants Near You Can Do for Your Business

For any business, keeping track of the inflow and outflow of money is important. Accountants use a chart of accounts to record the amount of money coming in and going out, but that’s not all. These data play a significant role in determining the business’s profitability, identifying the weak points, and creating action plans that will help to improve a product or service that customers will keep coming back to.

Restaurant accounting services in Fort Collins are no different. Professional CPAs work on financial information and use the details to grow the business. But, it’s a meticulous job. Many pieces of information and several documents need to be organized and prepared for better market analysis.

Balance Sheet Accounts

The balance sheet account is a standard accounting document that every business owner must prepare. It consists of:

- Assets

- Liabilities

- Equity

A start-up restaurant business may not be this detailed, but as the business grows, it becomes crucial. Having a balance sheet helps determine your restaurant’s financial performance and make the necessary adjustments.

Income Statement Accounts

The income statement accounts will contain the following information:

- Cost of goods (COGs) or the total cost of materials/ingredients used to create the menu items.

- Expenses such as utilities, occupancy, operating costs, and labor costs.

- Prime cost, which is essentially the sum of labor cost and COGs.

On your own, analyzing the numbers can be overwhelming especially if you are new in this industry and not an accountant. Collecting this data is important to have an idea of your business’s financial health. The charts will show you the cost-to-sales ratio and whether you are even staying afloat in your business.

By looking at the number of sales coming in vs expenses, it is easier to identify the issues and take the necessary action to address them.

Restaurant Business Taxes

Restaurant businesses handle taxes differently, and they need to be addressed on time. There are a number of these tax obligations and incentives that you can take advantage of:

- Food and beverage costs

- Federal and state income taxes

- Federal payroll taxes

- Sales and use taxes (depending on the state)

- Employee benefits

- Equipment depreciation

- Worker tax credits

- Charitable donations

- Energy-efficient upgrades

In Fort Collins, the state tax rate is 2.90%, and the average local tax is 4.75%. Find a “restaurant CPA near me” to help you with all the taxes that restaurant owners need to settle, as well as their schedules, so you do not miss a deadline and avoid penalties.

The Advantages of Hiring a Restaurant CPA Near You

Restaurant accounting and management seem to be two different worlds. Both can be demanding, and you cannot serve two masters at the same time. Your restaurant may still be small and you can juggle administration, marketing, and accounting without hassles for now as long as you stay organized.

Most restaurant owners perform a regular inventory (e.g., weekly, fortnightly, or monthly) to keep track of sales and expenses. While doing all the work or with a small team, the thought of expanding is always there. You can keep this up as your client base grows and your restaurant gains momentum.

Soon, you may find yourself struggling. When this happens, you will realize the need for a restaurant accounting firm to maintain your books.

It helps improve your customer service

When a professional takes care of your books, you can easily find out which items on your menu perform and which do not. Through detailed accounting data, you can identify peak and off-peak seasons and then set early for these periods.

CPAs keep you on top of things, especially in terms of taxes

Timely and precise tax reporting is critical. Firms in Fort Collins that offer restaurant accounting services know this very well so if you hire one, you can rest assured that your tax obligations are handled efficiently.

With Fort Collins restaurant accounting services, your cash flow is organized.

Aside from spotting food trends and developing your menu, lots of other operation-related issues may require your attention. As a business owner, you should be prepared for emergencies especially those that involve money. You should have ready funds for unexpected equipment repair, for example, and you won’t have a problem taking care of such incidents if your cash flow is organized.

How Restaurant Accounting Services in Fort Collins Can Help You Grow Your Business

Whether you are a start-up or a long-time restaurant business owner, restaurant accounting services in Fort Collins are crucial. Unlike other businesses, restaurants involve many expenses that you need to track and meticulously record. Regular inventory is required to operate and serve your customers efficiently.

Whether you are a start-up or a long-time restaurant business owner, restaurant accounting services in Fort Collins are crucial. Unlike other businesses, restaurants involve many expenses that you need to track and meticulously record. Regular inventory is required to operate and serve your customers efficiently.

If you want a reliable restaurant accounting firm to help you, Steven J. Wick & Associate is at your service. As a full-service accounting firm, we will make sure that everything in your books is aligned and ready to go when you need to look at any numbers.

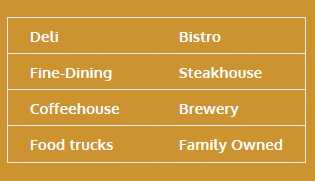

Within the general term “restaurant industry”, we understand there are specific types of restaurants and other food businesses. Food trucks are not the same as sit-down family-owned establishments that have been around for generations. Because of our specific knowledge of every food establishment, we have had success helping restaurants like yours when it comes to things like paying the bills, knowing when to expand, and getting as much money back from the government as possible.

We can also help you with business strategy, and figuring out things like when you can open that new spot, and how much you can afford to spend on paying employees this year. We also know the specifics of the restaurant industry when it comes to taxes. There are a number of different tax credits and deductions that can be made if you own a restaurant, and many of those things go unclaimed by restaurant owners every year due to a lack of knowledge. Our business advice and tax audit solutions will improve your business’s bottom line and operational efficiencies.

Steven J. Wick & Associates, P.C. has been offering business advice, tax audit, and tax strategy to restaurant owners for many years now. We know what to do to make sure that your business runs smoothly from an accounting standpoint without the need for your constant input. Whenever you need details about your business, we will be ready to hand those to you. It’s not easy to keep a restaurant afloat, but we can help you achieve this goal by providing you with the tax information that you need.

Let us help you take your restaurant business to the next level. Call us today!

Our Services:

- Tax audit help. We can help when the government wants to audit your business.

- Making sure that you are up to code with the department of labor.

- Reporting your correct numbers to the IRS and getting you the tax breaks you deserve.

- How to handle employee turnover. We have this information available for you.

CONTACT US

If you are having a hard time balancing your restaurant books, call SJ Wick today to arrange a consultation appointment. CPAs Fort Collins Colorado. We would love to provide restaurant accounting solutions, business strategy advice, and tax audit services to help your business thrive. Call SJ Wick for help with your restaurant accounting today. We’ll make your life a lot simpler!

Restaurant Accounting

New and seasoned restaurateurs know just how hard balancing the books can be with limited time, accounting knowledge, and personnel. When the going gets tough, the survival of your restaurant business will depend on restaurant accounting services in Fort Collins.

Restaurant Accounting Services: The Basics You Need to Know

Many entrepreneurs dive into the restaurant business because food is a necessity, and therefore a lucrative venture. With that said, competition is tough, and as early as the planning stage, you may find yourself struggling for new ideas that can lead to profits and success, as well as satisfied patrons.

Product and marketing are only two of the common issues any restaurant business owner would face. Accounting is another level. While running a restaurant is a challenging yet fulfilling business venture, the accounting issues are off-putting.

What Restaurant Accountants Near You Can Do for Your Business

For any business, keeping track of the inflow and outflow of money is important. Accountants use a chart of accounts to record the amount of money coming in and going out, but that’s not all. These data play a significant role in determining the business’s profitability, identifying the weak points, and creating action plans that will help to improve a product or service that customers will keep coming back to.

Restaurant accounting services in Fort Collins are no different. Professional CPAs work on financial information and use the details to grow the business. But, it’s a meticulous job. Many pieces of information and several documents need to be organized and prepared for better market analysis.

Balance Sheet Accounts

The balance sheet account is a standard accounting document that every business owner must prepare. It consists of:

- Assets

- Liabilities

- Equity

A start-up restaurant business may not be this detailed, but as the business grows, it becomes crucial. Having a balance sheet helps determine your restaurant’s financial performance and make the necessary adjustments.

Income Statement Accounts

The income statement accounts will contain the following information:

- Cost of goods (COGs) or the total cost of materials/ingredients used to create the menu items.

- Expenses such as utilities, occupancy, operating costs, and labor costs.

- Prime cost, which is essentially the sum of labor cost and COGs.

On your own, analyzing the numbers can be overwhelming especially if you are new in this industry and not an accountant. Collecting this data is important to have an idea of your business’s financial health. The charts will show you the cost-to-sales ratio and whether you are even staying afloat in your business.

By looking at the number of sales coming in vs expenses, it is easier to identify the issues and take the necessary action to address them.

Restaurant Business Taxes

Restaurant businesses handle taxes differently, and they need to be addressed on time. There are a number of these tax obligations and incentives that you can take advantage of:

- Food and beverage costs

- Federal and state income taxes

- Federal payroll taxes

- Sales and use taxes (depending on the state)

- Employee benefits

- Equipment depreciation

- Worker tax credits

- Charitable donations

- Energy-efficient upgrades

In Fort Collins, the state tax rate is 2.90%, and the average local tax is 4.75%. Find a “restaurant CPA near me” to help you with all the taxes that restaurant owners need to settle, as well as their schedules, so you do not miss a deadline and avoid penalties.

The Advantages of Hiring a Restaurant CPA Near You

Restaurant accounting and management seem to be two different worlds. Both can be demanding, and you cannot serve two masters at the same time. Your restaurant may still be small and you can juggle administration, marketing, and accounting without hassles for now as long as you stay organized.

Most restaurant owners perform a regular inventory (e.g., weekly, fortnightly, or monthly) to keep track of sales and expenses. While doing all the work or with a small team, the thought of expanding is always there. You can keep this up as your client base grows and your restaurant gains momentum.

Soon, you may find yourself struggling. When this happens, you will realize the need for a restaurant accounting firm to maintain your books.

It helps improve your customer service

When a professional takes care of your books, you can easily find out which items on your menu perform and which do not. Through detailed accounting data, you can identify peak and off-peak seasons and then set early for these periods.

CPAs keep you on top of things, especially in terms of taxes

Timely and precise tax reporting is critical. Firms in Fort Collins that offer restaurant accounting services know this very well so if you hire one, you can rest assured that your tax obligations are handled efficiently.

With Fort Collins restaurant accounting services, your cash flow is organized.

Aside from spotting food trends and developing your menu, lots of other operation-related issues may require your attention. As a business owner, you should be prepared for emergencies especially those that involve money. You should have ready funds for unexpected equipment repair, for example, and you won’t have a problem taking care of such incidents if your cash flow is organized.

How Restaurant Accounting Services in Fort Collins Can Help You Grow Your Business

Whether you are a start-up or a long-time restaurant business owner, restaurant accounting services in Fort Collins are crucial. Unlike other businesses, restaurants involve many expenses that you need to track and meticulously record. Regular inventory is required to operate and serve your customers efficiently.

Whether you are a start-up or a long-time restaurant business owner, restaurant accounting services in Fort Collins are crucial. Unlike other businesses, restaurants involve many expenses that you need to track and meticulously record. Regular inventory is required to operate and serve your customers efficiently.

If you want a reliable restaurant accounting firm to help you, Steven J. Wick & Associate is at your service. As a full-service accounting firm, we will make sure that everything in your books is aligned and ready to go when you need to look at any numbers.

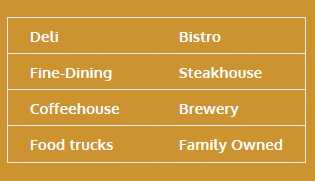

Within the general term “restaurant industry”, we understand there are specific types of restaurants and other food businesses. Food trucks are not the same as sit-down family-owned establishments that have been around for generations. Because of our specific knowledge of every food establishment, we have had success helping restaurants like yours when it comes to things like paying the bills, knowing when to expand, and getting as much money back from the government as possible.

We can also help you with business strategy, and figuring out things like when you can open that new spot, and how much you can afford to spend on paying employees this year. We also know the specifics of the restaurant industry when it comes to taxes. There are a number of different tax credits and deductions that can be made if you own a restaurant, and many of those things go unclaimed by restaurant owners every year due to a lack of knowledge. Our business advice and tax audit solutions will improve your business’s bottom line and operational efficiencies.

Steven J. Wick & Associates, P.C. has been offering business advice, tax audit, and tax strategy to restaurant owners for many years now. We know what to do to make sure that your business runs smoothly from an accounting standpoint without the need for your constant input. Whenever you need details about your business, we will be ready to hand those to you. It’s not easy to keep a restaurant afloat, but we can help you achieve this goal by providing you with the tax information that you need.

Let us help you take your restaurant business to the next level. Call us today!

Our Services:

- Tax audit help. We can help when the government wants to audit your business.

- Making sure that you are up to code with the department of labor.

- Reporting your correct numbers to the IRS and getting you the tax breaks you deserve.

- How to handle employee turnover. We have this information available for you.

CONTACT US

If you are having a hard time balancing your restaurant books, call SJ Wick today to arrange a consultation appointment. CPAs Fort Collins Colorado. We would love to provide restaurant accounting solutions, business strategy advice, and tax audit services to help your business thrive. Call SJ Wick for help with your restaurant accounting today. We’ll make your life a lot simpler!

Restaurant Accounting

New and seasoned restaurateurs know just how hard balancing the books can be with limited time, accounting knowledge, and personnel. When the going gets tough, the survival of your restaurant business will depend on restaurant accounting services in Fort Collins.

Restaurant Accounting Services: The Basics You Need to Know

Many entrepreneurs dive into the restaurant business because food is a necessity, and therefore a lucrative venture. With that said, competition is tough, and as early as the planning stage, you may find yourself struggling for new ideas that can lead to profits and success, as well as satisfied patrons.

Product and marketing are only two of the common issues any restaurant business owner would face. Accounting is another level. While running a restaurant is a challenging yet fulfilling business venture, the accounting issues are off-putting.

What Restaurant Accountants Near You Can Do for Your Business

For any business, keeping track of the inflow and outflow of money is important. Accountants use a chart of accounts to record the amount of money coming in and going out, but that’s not all. These data play a significant role in determining the business’s profitability, identifying the weak points, and creating action plans that will help to improve a product or service that customers will keep coming back to.

Restaurant accounting services in Fort Collins are no different. Professional CPAs work on financial information and use the details to grow the business. But, it’s a meticulous job. Many pieces of information and several documents need to be organized and prepared for better market analysis.

Balance Sheet Accounts

The balance sheet account is a standard accounting document that every business owner must prepare. It consists of:

- Assets

- Liabilities

- Equity

A start-up restaurant business may not be this detailed, but as the business grows, it becomes crucial. Having a balance sheet helps determine your restaurant’s financial performance and make the necessary adjustments.

Income Statement Accounts

The income statement accounts will contain the following information:

- Cost of goods (COGs) or the total cost of materials/ingredients used to create the menu items.

- Expenses such as utilities, occupancy, operating costs, and labor costs.

- Prime cost, which is essentially the sum of labor cost and COGs.

On your own, analyzing the numbers can be overwhelming especially if you are new in this industry and not an accountant. Collecting this data is important to have an idea of your business’s financial health. The charts will show you the cost-to-sales ratio and whether you are even staying afloat in your business.

By looking at the number of sales coming in vs expenses, it is easier to identify the issues and take the necessary action to address them.

Restaurant Business Taxes

Restaurant businesses handle taxes differently, and they need to be addressed on time. There are a number of these tax obligations and incentives that you can take advantage of:

- Food and beverage costs

- Federal and state income taxes

- Federal payroll taxes

- Sales and use taxes (depending on the state)

- Employee benefits

- Equipment depreciation

- Worker tax credits

- Charitable donations

- Energy-efficient upgrades

In Fort Collins, the state tax rate is 2.90%, and the average local tax is 4.75%. Find a “restaurant CPA near me” to help you with all the taxes that restaurant owners need to settle, as well as their schedules, so you do not miss a deadline and avoid penalties.

The Advantages of Hiring a Restaurant CPA Near You

Restaurant accounting and management seem to be two different worlds. Both can be demanding, and you cannot serve two masters at the same time. Your restaurant may still be small and you can juggle administration, marketing, and accounting without hassles for now as long as you stay organized.

Most restaurant owners perform a regular inventory (e.g., weekly, fortnightly, or monthly) to keep track of sales and expenses. While doing all the work or with a small team, the thought of expanding is always there. You can keep this up as your client base grows and your restaurant gains momentum.

Soon, you may find yourself struggling. When this happens, you will realize the need for a restaurant accounting firm to maintain your books.

It helps improve your customer service

When a professional takes care of your books, you can easily find out which items on your menu perform and which do not. Through detailed accounting data, you can identify peak and off-peak seasons and then set early for these periods.

CPAs keep you on top of things, especially in terms of taxes

Timely and precise tax reporting is critical. Firms in Fort Collins that offer restaurant accounting services know this very well so if you hire one, you can rest assured that your tax obligations are handled efficiently.

With Fort Collins restaurant accounting services, your cash flow is organized.

Aside from spotting food trends and developing your menu, lots of other operation-related issues may require your attention. As a business owner, you should be prepared for emergencies especially those that involve money. You should have ready funds for unexpected equipment repair, for example, and you won’t have a problem taking care of such incidents if your cash flow is organized.

How Restaurant Accounting Services in Fort Collins Can Help You Grow Your Business

Whether you are a start-up or a long-time restaurant business owner, restaurant accounting services in Fort Collins are crucial. Unlike other businesses, restaurants involve many expenses that you need to track and meticulously record. Regular inventory is required to operate and serve your customers efficiently.

Whether you are a start-up or a long-time restaurant business owner, restaurant accounting services in Fort Collins are crucial. Unlike other businesses, restaurants involve many expenses that you need to track and meticulously record. Regular inventory is required to operate and serve your customers efficiently.

If you want a reliable restaurant accounting firm to help you, Steven J. Wick & Associate is at your service. As a full-service accounting firm, we will make sure that everything in your books is aligned and ready to go when you need to look at any numbers.

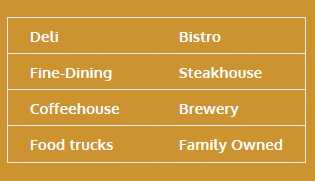

Within the general term “restaurant industry”, we understand there are specific types of restaurants and other food businesses. Food trucks are not the same as sit-down family-owned establishments that have been around for generations. Because of our specific knowledge of every food establishment, we have had success helping restaurants like yours when it comes to things like paying the bills, knowing when to expand, and getting as much money back from the government as possible.

We can also help you with business strategy, and figuring out things like when you can open that new spot, and how much you can afford to spend on paying employees this year. We also know the specifics of the restaurant industry when it comes to taxes. There are a number of different tax credits and deductions that can be made if you own a restaurant, and many of those things go unclaimed by restaurant owners every year due to a lack of knowledge. Our business advice and tax audit solutions will improve your business’s bottom line and operational efficiencies.

Steven J. Wick & Associates, P.C. has been offering business advice, tax audit, and tax strategy to restaurant owners for many years now. We know what to do to make sure that your business runs smoothly from an accounting standpoint without the need for your constant input. Whenever you need details about your business, we will be ready to hand those to you. It’s not easy to keep a restaurant afloat, but we can help you achieve this goal by providing you with the tax information that you need.

Let us help you take your restaurant business to the next level. Call us today!

Our Services:

- Tax audit help. We can help when the government wants to audit your business.

- Making sure that you are up to code with the department of labor.

- Reporting your correct numbers to the IRS and getting you the tax breaks you deserve.

- How to handle employee turnover. We have this information available for you.

CONTACT US

If you are having a hard time balancing your restaurant books, call SJ Wick today to arrange a consultation appointment. CPAs Fort Collins Colorado. We would love to provide restaurant accounting solutions, business strategy advice, and tax audit services to help your business thrive. Call SJ Wick for help with your restaurant accounting today. We’ll make your life a lot simpler!