Payroll outsourcing is becoming a popular option for small businesses in Fort Collins. Why? One of the most demanding, difficult, and time-consuming aspects of bookkeeping services is payroll accounting. This is true regardless of company size. No matter how many employees, contractor workers, or other personnel you pay in any form for any service for your business, the amount of paperwork is the same.

Government regulations don’t vary by the number of employees. Even if you use contract labor, or send out work to self-employed specialists who bill you, these services require payroll accounting just as taking care of your employees does.

The variations in what needs to be filed, what items need to be recorded, and the various elements of bookkeeping that need to be maintained are more dependent on items such as:

- Salaried employees

- Hourly employees

- Contract work

With these different categories of compensation, payroll accounting will require different elements based on how your business compensates its workforce. And, if you’re like most businesses, you probably compensate your staff in different ways. Some are hourly, others are salaried. Then, of course, there are contract workers.

Even small business payroll will likely have more than one kind of compensation for its owners, employees, and managers. Each different kind of compensation requires a different set of accounting procedures and record keeping.

Because of the time it demands and the amount of money, it requires to accomplish the employees’ salary computation, payroll outsourcing for a small business in Fort Collins has become a more viable option.

What is Payroll Outsourcing for Small Businesses in Fort Collins?

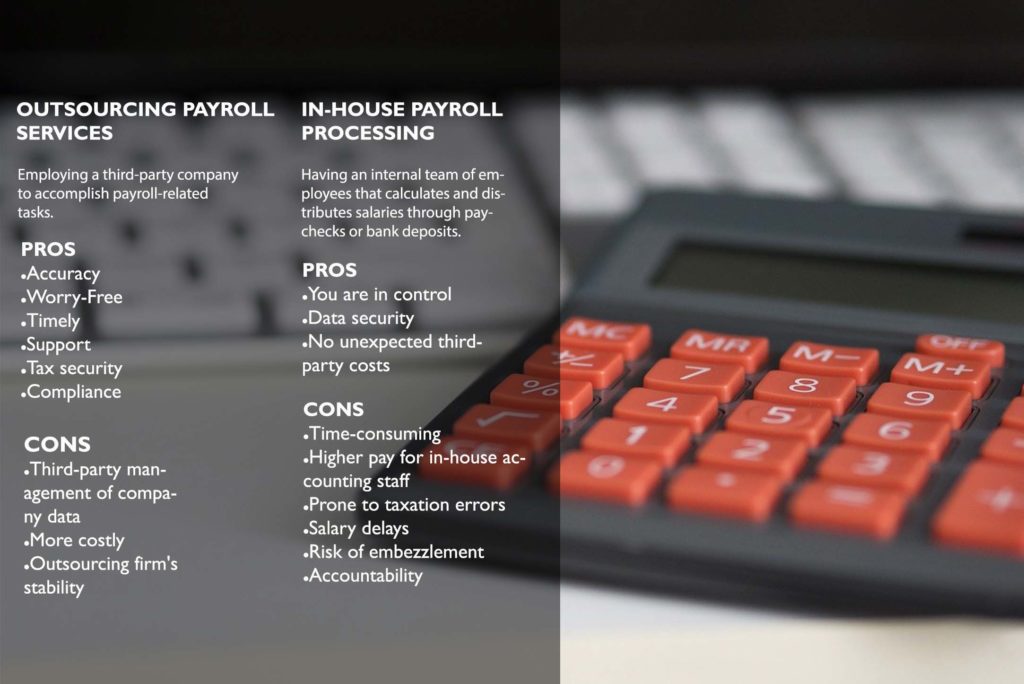

Payroll outsourcing for a small business works more effectively for entrepreneurs in Fort Collins. It means employing a third-party company to accomplish payroll-related tasks instead of setting up an internal team to handle this.

Aspects of Payroll Accounting

Payroll processing seems easy if your small business employs a few staff, but it can get daunting when you have more. That’s because salary computation – depending on the industry you’re in, the size of your manpower, and the financial perks that you offer – involves different aspects, some of which include:

- Wages

- Salaries

- Overtime compensation

- Tips

- Bonuses

- Type of compensation for each individual

- Payroll taxes and costs

- Social Security

- Medicare

- Federal income tax

- State income tax

- State unemployment tax

- Federal unemployment tax

- Worker compensation insurance

- Education benefits

Then, you have to have a reliable bookkeeping service to handle and take care of the taxation requirements, which may vary by municipality and state. If your business has more than one location, and they are not in the same area, the tax accounting for your payroll could be different for each location.

In addition to compensation and taxes, payroll accounting involves Items that have to be filed correctly, thoroughly, and within a specified time frame including items such as:

- Accounting for any benefits your employees receive, including medical care, bonuses, 401K programs, and even free services.

- Employer-paid benefits

- Holidays

- Vacations

- Sick days

- Insurance (health, dental, vision, life, disability)

- Retirement plans

- Profit-sharing plans

In-House Payroll vs Outsourcing

One of your major responsibilities as a business owner is to take care of your workers who keep your business running. It is your priority to make sure they get paid right and on time. There are two ways to do this: in-house payroll and outsourcing.

In-House Payroll

With an in-house payroll system, you have your internal human resource department handle the distribution of salaries through paychecks or direct bank deposits. Your internal payroll processing team is also classified as your employees, and therefore gets paid through the same system.

In-house payroll follows the standard salary distribution system.

The human resource team tracks the hours of employees paid hourly and computes the total to determine the gross and net pay from cut-off to cut-off. This includes deducting taxes and contributions.

Your payroll staff withdraws money from the payroll bank account that you set up for the company every scheduled payday.

Payroll Outsourcing

Outsourcing is hiring a third-party payroll outsourcing firm or individual in Fort Collins to process your company’s payroll. Although each payroll provider follows its own processing system, the procedures are standard:

You sign up and set up an account with the payroll outsourcing firm in Fort Collins

Based on the employees’ timesheets, data, tax, and contribution records that your company provides, the provider processes the payroll automatically according to schedule.

You or an authorized representative from your company approves the paychecks.

Fort Collins Outsourcing Payroll Services – The Pros and Cons

Outsourcing payroll services have positive and negative impacts. We’ve listed some of them so you can review how this option can help your business or why you should think twice.

Advantages of Payroll Outsourcing for your Small Business in Fort Collins

Payroll outsourcing for your small business in Fort Collins is an efficient way to manage your employees’ salaries and benefits. This method has other positive points:

Payroll Outsourcing Guarantees Accuracy

Payroll outsourcing for your small business in Fort Collins will guarantee accuracy. Remember that you are working with accounting experts, professionals who are experienced in dealing with numbers. By using a payroll outsourcing firm, you do not have to worry about common accounting errors.

Worry-Free Payroll Process

Payroll outsourcing is preferably more hassle-free on the employer’s end because these firms follow internal systems already set up. After providing them with the employee data and setting your salary distribution schedule, you can step back and let them do the rest. There may be occasional consultations with your Fort Collins firm, which won’t take up much of your time, but other than that, you can relax.

Timely Salary Distribution

Companies providing payroll services in Fort Collins are responsible for the timely salary distribution to your employees. Not only will it ensure your company’s compliance with state and federal requirements, but it also boosts your employees’ confidence and satisfaction.

Constant Support from Outsourcing Payroll Firms in Fort Collins

The payroll outsourcing firm’s job does not end when payday is over. Aside from continuously working on your employees’ salary computations, payroll outsourcing services also provide support whenever accounting issues arise. This will make you feel confident that problems will be addressed and resolved in a timely and reasonable manner.

More Time for Business and Less Time for Administrative Functions

A payroll outsourcing firm will deal with all payroll matters. This means that you and your team can focus more on profit-generating activities.

Your Fort Collins Business Will Be Safe from Tax Issues

One of the many values of payroll outsourcing for your small business in Fort Collins is security from tax penalties and fines. Keep in mind that firms offering payroll services are tax masters. They are responsible for collecting and deducting tax payments, which they are adept in.

Strict Compliance

A good payroll outsourcing firm operates according to industry standards and applies the best accounting practices. This equates to compliance with rules that the federal and state governments have set. These firms are governed by strict accounting policies so you can be sure of their compliance and your company is not likely to be held liable for any violations.

Disadvantages of Payroll Outsourcing for a Small Business in Fort Collins

Employee and Company Data is Managed by a Third-Party

When you hire a payroll outsourcing firm, you have to turn over some critical information about your company and employees to a third-party team. This process may put your company at risk for a security breach if you do not screen the firm carefully. It is important to always do some background checks before signing up with a company to ensure that such sensitive information is safe.

Choosing Payroll Outsourcing for your Small Business in Fort Collins May Cost a Little More

Compared to in-house payroll, outsourcing could be a little more expensive, but this is dependent on the company you choose. The price may vary from firm to firm. It is recommended to compare prices and assess if their fees are comparable with the quality of the payroll services they provide for Fort Collins businesses.

The Company’s Stability May Be an Issue

Stability is also a major issue. The firm you signed up with can go out of business anytime and this is something you cannot control. Either the firm folds or uses your funds for a different purpose. This is why you should evaluate the company’s track record, and years in business, and identify its clientele to help you determine its reliability.

In-House Payroll Processing – The Pros and Cons

Like many things, in-house payroll processing has advantages and disadvantages. Knowing the pros and cons will help you decide if in-house is the best choice for your business while considering also the size of your company, its standards, and structure.

Advantages of In-House Payroll for your Small Business in Fort Collins

You are In Control

The primary benefit of in-house payroll processing is having full control over the system. You can develop your own procedures and workflow according to your company’s needs. Errors should any occur, can be corrected immediately. Adjustments can also be made in real-time if necessary.

Data Security

You can be sure that your company and employees’ data are secured if you leave the payroll processing to your internal staff. Data pass through fewer people lowering any threats to sensitive information’s security.

It’s Less Costly

Outsourcing could be more expensive than in-house payroll processing. If your company is tight on budget, you would spend less with an internal accounting team to handle the compensations.

Disadvantages of In-House Payroll Processing

It’s Time-Consuming

If you have several employees to take care of, it is likely that you will be in charge of their payroll, and the time you need to spend calculating hours and making deductions is not a joke, even if you do not do the tasks directly. You still have to review the numbers, verify, and check if the computations are correct. This is not a smart way to handle a business especially if yours is a start-up.

The Cost of an In-House Staff May Be Bigger

If you sum up the costs of labor, fees for software and maintenance, and miscellaneous expenses, you could be paying more than outsourcing the company payroll. If you won’t be automating your payroll system and use manpower entirely, the overtime pays will get you.

You Could Be Fined for Taxation Errors

One of the worst things that can happen should you decide to do your payroll is being fined for errors in tax collections. It is a complicated matter that needs to be done right and on time. If you do not have a CPA background, the chances of making tax calculation mistakes are high resulting in fines and penalties.

Salary Delays

For a non-CPA, doing payroll would be time-consuming, and this may lead to delays in salary distribution. Such instances say a lot about how a company takes care of its people. Delays may also lower the employees’ confidence and satisfaction, thus affecting compliance. It may seem a small issue, but it would actually affect the company’s overall operations, which means losing more than gaining.

Dealing with More Tax Issues in Fort Collins

Doing in-house payroll means dealing with more tax issues. There’s the timely and accurate filing of tax reports, quarterly and annually. You have to pay a penalty of 10% if delayed by 16 days or more.

You Open Your Company Up for Possible Embezzlement

Another very real concern with an in-house accountant or bookkeeper is theft. Embezzlement is becoming ridiculously commonplace and this practice is extremely harmful to any business. Your in-house payroll staff can get away with embezzlement because they can play your company’s accounting system especially when they already know it so well. It can cause financial distress that you may not be able to recover from if not prevented soon.

Accountability

Additionally, your in-house bookkeeper is not providing his service with a backup guarantee that any errors will be corrected out of his pocket. Most outside payroll accounting companies bond and license their accountants, and guarantee accurate timely filing of all documents, or they pay the difference. There are many ethical, talented bookkeepers that work for companies, but even in this case, if they make a mistake, you will end up paying the penalty for it.

When Should You Outsource Your Payroll?

So, should you choose payroll outsourcing for your small business in Fort Collins? Payroll accounting can be overwhelming and is more complex than you think, even for small businesses. Many accounting programs are available on the market to aid you with payroll accounting, and some are pretty good. But the fact remains that a bookkeeping program you might purchase may not cover everything it needs to for your business.

You may hire an in-house accountant who hopefully is very good at what she does. If either of those satisfies your payroll accounting, that is good. But what many businesses are discovering is that the best payroll accounting service, the one least prone to mistakes, is actually outside bookkeeping services. Your CPA specializes in all the aspects of keeping your payroll well documented, and correct, and has the know-how to file everything from payroll taxes to workmen’s compensation to the cost of training seminars for your employees.

These are invaluable assets when it comes to something so crucial as payroll accounting. An accounting firm with an expert payroll department is overall the safest bet to ensure that payroll is done correctly and on time, especially when meeting local, state, and federal requirements.

Steven J Wick and Associates P.C. stays true to its vision, mission, and goals: Provide the highest level of service at reasonable costs and help you bring your business to the next level. If you are looking for a reliable payroll outsourcing firm that provides A-list payroll preparation, accounting, bookkeeping, and tax preparation solutions, we invite you to reach out to us.

Give us a call today, and let’s talk!