More About Small Business Taxes

More About Small Business Taxes

How can you find a trusted and talented CPA tax accountant out of thousands in Fort Collins? And why is reputation so important? For one thing, tax duties are serious, and it can take too much time away from your business. Imagine the paperwork, financial analysis, money matter to settle for a clean tax record, financial decisions you have to make at the last minute, debts, and the list goes on. If you are not a tax expert, completing the task may seem impossible.

For a business, these are important matters that need special attention. Thus, the need for hiring the best CPA tax accountant. But how can you be sure you are picking the right person for the job?

We have tips to help you better understand how to find the best accountant for your situation, and information on the various small business tax services that we offer, which will help ease your financial burdens.

More About Small Business Taxes

How can you find a trusted and talented CPA tax accountant out of thousands in Fort Collins? And why is reputation so important? For one thing, tax duties are serious, and it can take too much time away from your business. Imagine the paperwork, financial analysis, money matter to settle for a clean tax record, financial decisions you have to make at the last minute, debts, and the list goes on. If you are not a tax expert, completing the task may seem impossible.

For a business, these are important matters that need special attention. Thus, the need for hiring the best CPA tax accountant. But how can you be sure you are picking the right person for the job?

We have tips to help you better understand how to find the best accountant for your situation, and information on the various small business tax services that we offer, which will help ease your financial burdens.

The small business travel expense tax deduction is one of the perks of being an entrepreneur in Fort Collins. It helps lower the yearly income tax and reduces the amount of tax owed to the government. Also, when there are travel expense tax deductions that you can look forward to, it makes you a proactive business owner, leading to a healthy economy. Many businesses around the country took a serious hit due to the COVID-19 pandemic. Giving entrepreneurs tax incentives will inspire them a lot to go back or stay in business.

Having been in business for some time, you are probably already aware of the small business travel expense deductions in Fort Collins, but there are still some details you may be missing: what travel expenses are deductible? Who are qualified and what are the rules? Are there updates this year?

Get all the details in this article.

An Overview of Small Business Travel Expense Deductions

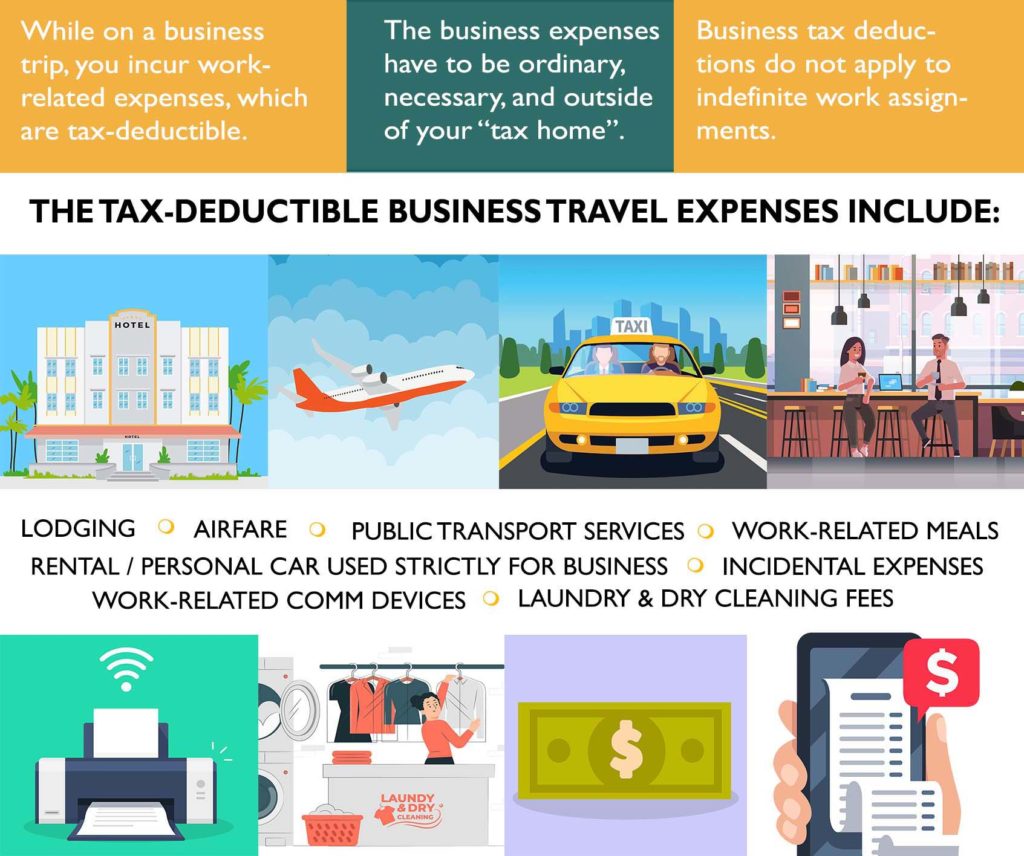

When you go on a business trip, you incur work-related expenses, such as air or taxi fare, lodging, meals, and the like. These expenses are tax-deductible as long as they are ordinary and necessary per IRS conditions. The business trip must also be outside of your “tax home.”

Take note that the small business tax deductions do not apply to indefinite work assignments. “Indefinite” pertains to jobs lasting more than away from your tax home.

What Travel Expenses Are Deductible for A Small Business

Perhaps you are assuming that all expenses incurred while on a business-related trip are covered, but there are also limitations and rules governing this tax deduction scheme. What travel expenses are deductible for a small business?

The list of travel expenses excludes fees for daily commutes. Here’s what’s included:

- Lodging

- Airfare

- Transports services (taxis, trains, or buses)

- Rental car or personal car used exclusively to transport you from home to your temporary work location

- Any location where your business meetings will be held

- Work-related meals (entertainment-related meals are excluded)

- Laundry and dry-cleaning fees

- Any form of communication devices used for business (fax machines, phones, computer rental, etc.)

- Incidental expenses (tips, minor fees)

Can Self-Employed Individuals Also Take Advantage of the Business Expense Tax Deductions?

Self-employed individuals are also qualified for small business expense deductions. In fact, there’s a wide range of tax-write offs available if you are operating as a sole proprietor, limited liability company, or partnership.

For a complete list of tax deductions for self-employed individuals, check out this article. On another note, we still recommend talking to a professional CPA for the exact details.

Small Business Travel Expense Deduction Update: What Makes It Different in 2021?

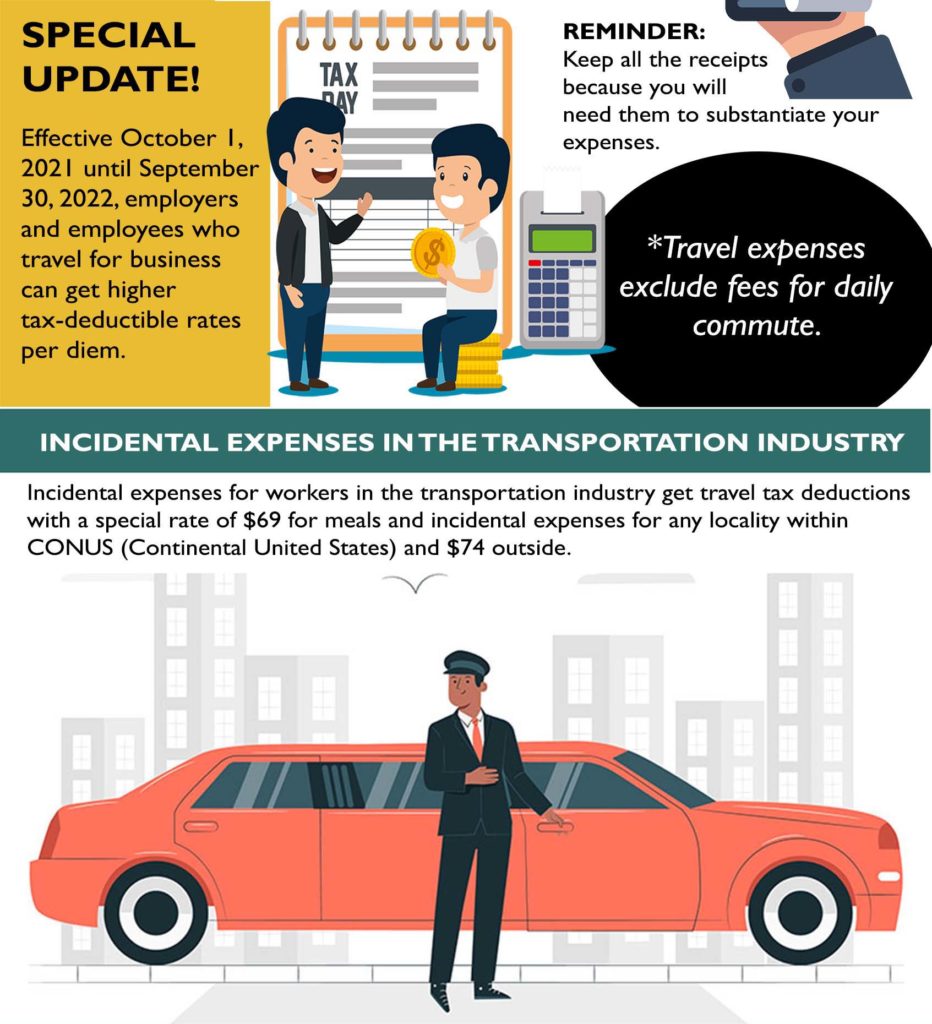

For sure, employers and employees who travel for business will be happy to learn that the Internal Revenue Service (IRS) has issued an updated tax deduction for travel expenses. Effective October 1, 2021, until September 30, 2022, you can get higher tax-deductible rates per diem. This new rate includes special per-diem rates and per-diem allowances paid to any employee on or after Oct. 1, 2021, for travel away from home on or after that date. With this update, you can easily substantiate your business-related travel expenses, as indicated in Notice 2021-52.

How Does the Updated Small Business Travel Expense Tax Deduction Work in Fort Collins?

How Does the Updated Small Business Travel Expense Tax Deduction Work in Fort Collins?

Travel expense reimbursements for tax deductions are a handful. A business owner or employee must substantiate ordinary and necessary business trip expenses by month. Any advances an employee or employer cannot substantiate within 120 days will be treated as non-accountable. The IRS will then convert the reimbursements into the employee’s taxable wages.

As you know, wages are subject to income and employment taxes. On the other hand, per diem reimbursements are non-taxable because they are not considered wages. Note that certain conditions apply for per diem payments to be non-taxable.

What’s with This “Per Diem” Method?

The per diem method makes reimbursing business travel expenses simple, not to mention the higher rates applicable for this year and the next. Here, you will use the tables provided by the IRS to determine the reimbursable amounts for meals and lodging and location-based incidental expenses. Keep all the receipts because you will need them to substantiate your expenses.

The general rules are detailed under Rev. Proc. 2019-48. Better yet, ask a CPA for complete information on small business travel expense tax deductions in Fort Collins.

Incidental expenses

Sure, the rates have changed but not all. The update excludes the incidental expenses as it remains at $5 per day for any locality. Covered are out-of-pocket fees and small costs such as tips for taxi drivers, ships and hotel staff, porters, baggage carriers, and the like. Incidentals may also be paid through petty cash or a company credit card.

Incidental Expenses in the Transportation Industry

What about employees in the transportation industry? Since they are travelling often, how does the small business travel expense tax deduction work in Fort Collins?

Yes, they still get travel tax deductions with a special rate of $69 for meals and incidental expenses for any locality within CONUS (Continental United States) and $74 outside. These rates are $3 higher than the previous year.

High-low Substantiation Method

The IRS set the high-low substantiation method as an alternative reimbursement method. Here, a flat rate of $296 per diem applies for high-cost locations (localities with at least $249 federal per diem rates) such as the District of Columbia, Chicago, and New York. For travel to other locations within CONUS, the flat rate is $202.

Sec. 274(n), which provides a list of conditions and high-cost localities, also indicates that employees are entitled to $74 for meals for travel in high-cost localities and $64 in localities within CONUS.

These updated rates are higher than last year’s.

The Tax Cuts and Jobs Act (TCJA) and A Few More Things to Remember

If you have not yet heard of the Tax Cuts and Jobs Act (TCJA), read carefully. When you travel for business, keep all your receipts safe because they are required for reporting come reimbursement time. Unreimbursed expenses will not be tax-deductible, as specified in Notice 2018-42.

An incomplete expense report will turn your business expenses into taxable payments. There is also a limit to the per diem rates. Going beyond the limit will result in taxable rates.

Saving While Traveling: These Small Business Travel Expense Deductions are Well Deserved

You could have spent your time traveling for business with your family, friends, or for yourself. Instead, you’re on a trip to increase your client base and business profits. Whether you are an employee or a Fort Collins business owner, you deserve these small business travel expense deductions. Take advantage of all of them because it would be a waste if you missed one.

Even with the details provided by the IRS, you may still find it confusing if your tax knowledge is limited. If you are in doubt, we recommend consulting a professional and talented CPA, who will provide you with all the details and guide you on how to use them. Certain things may be required, and conditions may apply, so it is better to have an expert back you.

Steven J. Wick & Associates, P.C. is an expert in accounting, bookkeeping, and taxes. Accounting and tax expert, Steve, will assist you in identifying whether you are qualified to avail of the travel tax deductions, the computations, and everything you need help with.

Small business travel expense tax deductions are not the company’s only expertise. Our team also offers payroll, bookkeeping, business consultancy, and tax services, among others. When the numbers get complicated or if your business needs a boost, Steven J. Wick & Associates, P.C.is just a phone call or an email away. Talk to us!