Subcontractor

If you have a career in the skilled trades, you’re no stranger to hard work. You use your tools, your hands, and your know-how to get the job done, sometimes working 12-hour days or scrambling to make tight deadlines. As opportunities grow, so is the financial complexity in keeping your business running. That’s why specialized accounting for construction contractors in Fort Collins isn’t just beneficial—it’s essential for sustainable growth and profitability.

Why Do Many Contractors Struggle with Accounting?

Often, tradespeople, construction workers, and contractors must juggle many tasks, clients, and paperwork to keep things running smoothly. You either put in more hours to do it yourself or rely on a receptionist or family member to manage their books.

Getting an accountant that understands the construction and construction subcontracting industry can be the difference between success and failure as a company.

However, taking on this complex task is stressful for everyone involved. More importantly, it can result in errors and other mishaps, some of which are serious and may damage the business. When you’re running to and from the job site or on call for residential emergencies, you don’t have the time or energy to make sure your bookkeeping is immaculate.

You shouldn’t have to endure the stress and take this massive risk! Unlike other industries, the construction industry involves a lot of different accounting situations that some accountants might not be familiar with. Hiring a qualified CPA that is familiar with skilled trades and related industries is one of the best business investments you can make.

With professional help, you can rest easily knowing that your books are clean and balanced, your payroll is handled on time, your bills can get paid efficiently, and you are good to go come tax time. And at SJ Wick, we understand the bookkeeping and accounting that go into construction contractors in Fort Collins.

Delegate Your Accounting Tasks and Focus on Growing Your Construction Business

If you’re great at fixing sinks or laying bricks, there’s no reason that you should also be great at accounting, too. Don’t try to do it all and end up burning yourself out. Stick with what you love, and delegate your important business tasks to third-party professionals.

When you hand off those bookkeeping headaches and tax filing nightmares to the experts, you free yourself up to focus on what you actually started your business for—wowing your clients with quality craftsmanship and building your construction business. Look for Fort Collins accounting firms specializing in the contractor and construction industry, so you know you’ll be in good hands.

What a Construction Accountant in Fort Collins Can Actually Do for You

Once you’ve laid the groundwork for your business, you must ensure your finances are equally well-prepared. For instance, there are hiring contracts to consider when it comes to a construction company. Making sure that your bookwork is prepared and maintained properly can mean the difference between keeping your employees happy and not.

A construction accounting professional will identify cost savings loopholes, assist with tax filing, and improve your company’s bottom line. Experienced accountants provide your business with competitive advantages through construction contractor tax savings strategy to thrive in Fort Collins.

Essential Accounting Services to Help Fort Collins Construction Contractors Succeed

Let’s face it—the construction industry needs a special kind of financial management that even regular accountants often don’t quite get. If you’re running a construction business in Fort Collins, here are some accounting services that can really make a difference to your success.

Job Costing and Project Profitability Tracking

In most cases, your profits aren’t measured quarterly like other businesses—they’re measured project by project. That’s why having specialized construction accounting in Fort Collins is so important. The right accounting partner will give you detailed job costing that tracks every dollar against your estimates, giving you a real-time view of how profitable each project actually is.

What makes job costing so crucial for your construction business? It’s all these moving parts:

- Your direct labor costs with proper burden allocation

- How much material you’re using and wasting

- How efficiently you’re using your equipment

- How much your subcontractors are costing you

- Financial impact when change orders come in

Track these details will help you spot patterns, such as which neighborhoods, project types, or crews are making you the most money. This helps you make smarter decisions about which jobs to bid on next.

Construction-Specific Cash Flow Management

Colorado’s construction season has its own rhythm. With busy building months followed by winter slowdowns, Fort Collins contractors face real challenges keeping cash flowing while also keeping your workforce intact.

An accounting team expert can guide you on how to manage cash flow for construction projects. They can also create cash flow projections that account for seasonal factors specific to Northern Colorado. This means you’ll be better prepared to keep money in the bank even during those predictably slow periods.

Financial Statements Optimized for Bonding and Lending

For construction contractors, financial statements have more uses than just for accounting and filing taxes in Fort Collins. These documents can also help your business in securing bonds, lines of credit, and project financing.

A good CPA may also act as a vital contact between your growing business, and banks or loan lenders. Especially within the construction industry, loans can become necessary when purchasing large or expensive equipment.

Some examples of specialized construction financial reporting include:

- WIP (Work-In-Progress) schedules that demonstrate project management capability

- Overhead allocation, risk management, job estimates, and special insurance or worker’s compensation

- Financial ratio analysis focused on benchmarks that matter to construction lenders

- Over/under billings analysis that signals proper project management

In essence, your accountant should be experienced working with construction companies and should have a good sense of the industry. A qualified accountant for construction contractors in Fort Collins will allow you to stay ahead of the game and ensure that all is running smoothly, so you can continue to focus on making your customers happy.

Mistakes Construction Contractors Often Make in Their Accounting

Did you know some of your “accounting” practices could actually be a big mistake? Check out some common mistakes construction contractors make:

- Using inconsistent files and poorly structured accounts: Many contractors create separate files for each project or job, then use an item list and chart of accounts that don’t accurately match the needs/expenses of their business. Creating custom item lists and charts of accounts may take some training, but it will enable business owners to track expenses and supplies more accurately.

- Mishandling vendor credits and customer payments: Failing to properly receive vendor credits against a bill or receiving payments from customers incorrectly can lead to messy financial records and costly errors.

- Not reconciling bank and credit card accounts: Construction business owners often fail to reconcile bank and credit card accounts, especially when using software like QuickBooks. Without regular reconciliation, discrepancies can go unnoticed for too long. So it is well worth asking for help from an accountant to understand how to perform this operation.

Do I Really Need a Construction-Specific Accounting Firm? 5 Reasons to Hire an Expert Accountant for Construction Contractors in Fort Collins

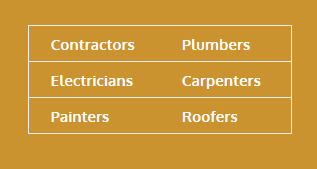

For those who work in skilled trades, like electricians, painters, and contractors, it’s worth seeking out an accountant who can speak your language. Here are three reasons why you should work with a CPA who understands your industry:

1. They understand the lingo

Each area of the skilled trades has its jargon, and it’s incredibly useful to work with someone who gets it. You want an accountant who knows your terms and expectations of your particular field, and who doesn’t need an explanation every time you talk about your job. This will help your interactions be smooth and hassle-free, and make you feel like you really have someone in your corner when you need them.

2. They aren’t intimidated by the paperwork

Owning and operating a small business isn’t easy, especially one that involves multiple clients, subcontractors, and suppliers. This is the normal way of things for electricians, roofers, and other construction workers, so it’s great to have a CPA who knows exactly how to file and track expense and revenue accounts.

3. They’re expert in handling tax season

For entrepreneurs and solo contractors, tax time can be a giant headache. But with the right accountant on board, your returns will be filled out correctly, and every aspect of your business for the past year will be accounted for. If you are intimidated by the tax process for small businesses, let a CPA handle the filing for you, so you know you will get the maximum return possible, and stay in compliance with state and federal laws.

Let Construction Accountants Help You Maximize Tax and Travel Deductions

There’s a lot of tax deductions that construction companies miss out on simply because nobody told them these opportunities exist. Think about all those business expenses you rack up—tools, driving around town, license fees, trade association dues—these are all potential tax deductions that can really add up. Just one catch: you can’t deduct anything a client paid you back for.

Going from jobsite to jobsite puts serious miles on your truck, but this another area where deductions can make a real impact. Tracking insurance, gas money, mileage, and even how much your vehicle depreciates may lead to significant tax savings.

It takes a skilled eye—and experience working with companies like yours—to navigate these tax rules and uncover every dollar you’re entitled to. Don’t give away more money than you have to. With the right accountant, you could put more of it back into your business.

4. They can keep your cash flow straight between contracts and services

There are also hiring contracts to consider when it comes to a construction company. Whether you are a painter or a plumber, making sure that your bookwork is prepared and maintained properly can mean the difference between keeping your employees happy and not.

5. They Help You Classify Workers Correctly

For the most part, construction work in Colorado is seasonal and requires seasonal or temporary labor. Since the construction industry often relies on subcontractors and independent contractors, as well as a dedicated crew, this is a key piece of tax filings.

As a general contractor, you may be tempted to rely on contract labor to avoid the tax burden. You may also have permanent staff, such as administrative staff or even some laborers, and it is important to classify these employees appropriately.

Misclassifying employees to avoid taxes is considered worker fraud by the IRS, even if the mistake is made in an attempt to simplify your finances. Managerial accounting support can help you determine the right way to deal with permanent and/or temporary workers.

An accountant will help you keep clean records and advise you on how to:

- Properly distinguish between contractors and employees

- File the correct forms (1099s vs W-2s)

- Avoid penalties related to misclassification

This step alone could save you from major compliance headaches. Make sure that your employees are classified correctly, and that your payroll accounts for all third parties, even the one specialist you called in for one job.

Working with a Local Accountant Means Specialized Insight into the Construction Business

Colorado is a small business-friendly state, and we have thousands of independently-owned companies here. One of the most vital industries is the skilled trades—plumbers, electricians, HVAC specialists, and other contractors—that provide highly valuable services for homes and businesses across the region.

The state’s construction industry is on a strong upward trajectory, with the Colorado Department of Labor and Employment projecting a 26% growth between 2020 and 2030. It’s also expected to open the door to more lucrative career opportunities, especially in specialty trades, where employment is forecasted to grow by 28%.

The weather and geographic area that Fort Collins lies in has its own challenges and opportunities for those in Northern Colorado. Only a CPA local to the area would be aware of and be able to incorporate into their projections.

Fluctuating Demand: An Example of Increased Construction Demand in Northern Colorado

In September 2013, much of Northern Colorado was deeply affected by flooding. It was estimated that nearly 1,800 homes were destroyed. The cost of rebuilding was anticipated to be astronomical, and construction contractors were put to the test on a variety of fronts. Not only will homes and businesses, as well as public infrastructure, need to be rebuilt quickly, but in many cases, the expenses of such jobs will challenge contractors to do more with less.

During the Colorado floods of 2013, an estimated 37,000 gallons of oil spilled into the Front Range landscape. Dealing with the safe rebuilding of infrastructure (such as in these circumstances) may entail hiring individuals with specific kinds of engineering experience. Some individuals weren’t sure whether to bring these specialized subcontractors on as employees or maintain a subcontractor relationship during the rebuild.

As a local CPA– Steven J. Wicks & Associates, PC has lived through this demand increase, and seen the seasonality trends that have developed in the construction industry in Fort Collins & Northern Colorado. With our specialized insight, we know how to better protect your business during demand changes while maintaining your projections.

Laying the Right Foundation with Accounting Firms for Construction Contractors in Fort Collins

Many people who are finishing training programs or apprenticeships desire to start their own companies, but only a handful of those people will go on to be successful. While the demand for these services will continue to be high, it’s important to lay the right foundation, so you can stand apart from the competition.

Each industry has its own special rules and regulations, and different daily operations, so it’s always best to find an accountant who specializes in your field and knows your local regulations. Knowing that you are looking for an accounting firm in Fort Collins that specializes in construction contractors can help the process of narrowing down your options, and reaching out to a firm or two can make the decision easy.

Find A Reliable Accounting Firm Specializing in Construction Industry for Your Construction Business in Fort Collins

The construction business comes with many different and unique accounting structures. If you run a construction or contracting company, you’ll need an accountant that understands the legal loopholes involved with this type of business.

Steven J. Wick & Associates P.C. provides customized accounting solutions for construction and contracting companies in or near Fort Collins. You should feel heard and understood by your CPA, as they will become a valued member of your company team. Whether you need someone to do your bookwork or just figure out a tricky tax situation, we can help. Call us today to book a consultation with one of our construction and contracting accounting experts!

Subcontractor

If you have a career in the skilled trades, you’re no stranger to hard work. You use your tools, your hands, and your know-how to get the job done, sometimes working 12-hour days or scrambling to make tight deadlines. As opportunities grow, so is the financial complexity in keeping your business running. That’s why specialized accounting for construction contractors in Fort Collins isn’t just beneficial—it’s essential for sustainable growth and profitability.

Why Do Many Contractors Struggle with Accounting?

Often, tradespeople, construction workers, and contractors must juggle many tasks, clients, and paperwork to keep things running smoothly. You either put in more hours to do it yourself or rely on a receptionist or family member to manage their books.

Getting an accountant that understands the construction and construction subcontracting industry can be the difference between success and failure as a company.

However, taking on this complex task is stressful for everyone involved. More importantly, it can result in errors and other mishaps, some of which are serious and may damage the business. When you’re running to and from the job site or on call for residential emergencies, you don’t have the time or energy to make sure your bookkeeping is immaculate.

You shouldn’t have to endure the stress and take this massive risk! Unlike other industries, the construction industry involves a lot of different accounting situations that some accountants might not be familiar with. Hiring a qualified CPA that is familiar with skilled trades and related industries is one of the best business investments you can make.

With professional help, you can rest easily knowing that your books are clean and balanced, your payroll is handled on time, your bills can get paid efficiently, and you are good to go come tax time. And at SJ Wick, we understand the bookkeeping and accounting that go into construction contractors in Fort Collins.

Delegate Your Accounting Tasks and Focus on Growing Your Construction Business

If you’re great at fixing sinks or laying bricks, there’s no reason that you should also be great at accounting, too. Don’t try to do it all and end up burning yourself out. Stick with what you love, and delegate your important business tasks to third-party professionals.

When you hand off those bookkeeping headaches and tax filing nightmares to the experts, you free yourself up to focus on what you actually started your business for—wowing your clients with quality craftsmanship and building your construction business. Look for Fort Collins accounting firms specializing in the contractor and construction industry, so you know you’ll be in good hands.

What a Construction Accountant in Fort Collins Can Actually Do for You

Once you’ve laid the groundwork for your business, you must ensure your finances are equally well-prepared. For instance, there are hiring contracts to consider when it comes to a construction company. Making sure that your bookwork is prepared and maintained properly can mean the difference between keeping your employees happy and not.

A construction accounting professional will identify cost savings loopholes, assist with tax filing, and improve your company’s bottom line. Experienced accountants provide your business with competitive advantages through construction contractor tax savings strategy to thrive in Fort Collins.

Essential Accounting Services to Help Fort Collins Construction Contractors Succeed

Let’s face it—the construction industry needs a special kind of financial management that even regular accountants often don’t quite get. If you’re running a construction business in Fort Collins, here are some accounting services that can really make a difference to your success.

Job Costing and Project Profitability Tracking

In most cases, your profits aren’t measured quarterly like other businesses—they’re measured project by project. That’s why having specialized construction accounting in Fort Collins is so important. The right accounting partner will give you detailed job costing that tracks every dollar against your estimates, giving you a real-time view of how profitable each project actually is.

What makes job costing so crucial for your construction business? It’s all these moving parts:

- Your direct labor costs with proper burden allocation

- How much material you’re using and wasting

- How efficiently you’re using your equipment

- How much your subcontractors are costing you

- Financial impact when change orders come in

Track these details will help you spot patterns, such as which neighborhoods, project types, or crews are making you the most money. This helps you make smarter decisions about which jobs to bid on next.

Construction-Specific Cash Flow Management

Colorado’s construction season has its own rhythm. With busy building months followed by winter slowdowns, Fort Collins contractors face real challenges keeping cash flowing while also keeping your workforce intact.

An accounting team expert can guide you on how to manage cash flow for construction projects. They can also create cash flow projections that account for seasonal factors specific to Northern Colorado. This means you’ll be better prepared to keep money in the bank even during those predictably slow periods.

Financial Statements Optimized for Bonding and Lending

For construction contractors, financial statements have more uses than just for accounting and filing taxes in Fort Collins. These documents can also help your business in securing bonds, lines of credit, and project financing.

A good CPA may also act as a vital contact between your growing business, and banks or loan lenders. Especially within the construction industry, loans can become necessary when purchasing large or expensive equipment.

Some examples of specialized construction financial reporting include:

- WIP (Work-In-Progress) schedules that demonstrate project management capability

- Overhead allocation, risk management, job estimates, and special insurance or worker’s compensation

- Financial ratio analysis focused on benchmarks that matter to construction lenders

- Over/under billings analysis that signals proper project management

In essence, your accountant should be experienced working with construction companies and should have a good sense of the industry. A qualified accountant for construction contractors in Fort Collins will allow you to stay ahead of the game and ensure that all is running smoothly, so you can continue to focus on making your customers happy.

Mistakes Construction Contractors Often Make in Their Accounting

Did you know some of your “accounting” practices could actually be a big mistake? Check out some common mistakes construction contractors make:

- Using inconsistent files and poorly structured accounts: Many contractors create separate files for each project or job, then use an item list and chart of accounts that don’t accurately match the needs/expenses of their business. Creating custom item lists and charts of accounts may take some training, but it will enable business owners to track expenses and supplies more accurately.

- Mishandling vendor credits and customer payments: Failing to properly receive vendor credits against a bill or receiving payments from customers incorrectly can lead to messy financial records and costly errors.

- Not reconciling bank and credit card accounts: Construction business owners often fail to reconcile bank and credit card accounts, especially when using software like QuickBooks. Without regular reconciliation, discrepancies can go unnoticed for too long. So it is well worth asking for help from an accountant to understand how to perform this operation.

Do I Really Need a Construction-Specific Accounting Firm? 5 Reasons to Hire an Expert Accountant for Construction Contractors in Fort Collins

For those who work in skilled trades, like electricians, painters, and contractors, it’s worth seeking out an accountant who can speak your language. Here are three reasons why you should work with a CPA who understands your industry:

1. They understand the lingo

Each area of the skilled trades has its jargon, and it’s incredibly useful to work with someone who gets it. You want an accountant who knows your terms and expectations of your particular field, and who doesn’t need an explanation every time you talk about your job. This will help your interactions be smooth and hassle-free, and make you feel like you really have someone in your corner when you need them.

2. They aren’t intimidated by the paperwork

Owning and operating a small business isn’t easy, especially one that involves multiple clients, subcontractors, and suppliers. This is the normal way of things for electricians, roofers, and other construction workers, so it’s great to have a CPA who knows exactly how to file and track expense and revenue accounts.

3. They’re expert in handling tax season

For entrepreneurs and solo contractors, tax time can be a giant headache. But with the right accountant on board, your returns will be filled out correctly, and every aspect of your business for the past year will be accounted for. If you are intimidated by the tax process for small businesses, let a CPA handle the filing for you, so you know you will get the maximum return possible, and stay in compliance with state and federal laws.

Let Construction Accountants Help You Maximize Tax and Travel Deductions

There’s a lot of tax deductions that construction companies miss out on simply because nobody told them these opportunities exist. Think about all those business expenses you rack up—tools, driving around town, license fees, trade association dues—these are all potential tax deductions that can really add up. Just one catch: you can’t deduct anything a client paid you back for.

Going from jobsite to jobsite puts serious miles on your truck, but this another area where deductions can make a real impact. Tracking insurance, gas money, mileage, and even how much your vehicle depreciates may lead to significant tax savings.

It takes a skilled eye—and experience working with companies like yours—to navigate these tax rules and uncover every dollar you’re entitled to. Don’t give away more money than you have to. With the right accountant, you could put more of it back into your business.

4. They can keep your cash flow straight between contracts and services

There are also hiring contracts to consider when it comes to a construction company. Whether you are a painter or a plumber, making sure that your bookwork is prepared and maintained properly can mean the difference between keeping your employees happy and not.

5. They Help You Classify Workers Correctly

For the most part, construction work in Colorado is seasonal and requires seasonal or temporary labor. Since the construction industry often relies on subcontractors and independent contractors, as well as a dedicated crew, this is a key piece of tax filings.

As a general contractor, you may be tempted to rely on contract labor to avoid the tax burden. You may also have permanent staff, such as administrative staff or even some laborers, and it is important to classify these employees appropriately.

Misclassifying employees to avoid taxes is considered worker fraud by the IRS, even if the mistake is made in an attempt to simplify your finances. Managerial accounting support can help you determine the right way to deal with permanent and/or temporary workers.

An accountant will help you keep clean records and advise you on how to:

- Properly distinguish between contractors and employees

- File the correct forms (1099s vs W-2s)

- Avoid penalties related to misclassification

This step alone could save you from major compliance headaches. Make sure that your employees are classified correctly, and that your payroll accounts for all third parties, even the one specialist you called in for one job.

Working with a Local Accountant Means Specialized Insight into the Construction Business

Colorado is a small business-friendly state, and we have thousands of independently-owned companies here. One of the most vital industries is the skilled trades—plumbers, electricians, HVAC specialists, and other contractors—that provide highly valuable services for homes and businesses across the region.

The state’s construction industry is on a strong upward trajectory, with the Colorado Department of Labor and Employment projecting a 26% growth between 2020 and 2030. It’s also expected to open the door to more lucrative career opportunities, especially in specialty trades, where employment is forecasted to grow by 28%.

The weather and geographic area that Fort Collins lies in has its own challenges and opportunities for those in Northern Colorado. Only a CPA local to the area would be aware of and be able to incorporate into their projections.

Fluctuating Demand: An Example of Increased Construction Demand in Northern Colorado

In September 2013, much of Northern Colorado was deeply affected by flooding. It was estimated that nearly 1,800 homes were destroyed. The cost of rebuilding was anticipated to be astronomical, and construction contractors were put to the test on a variety of fronts. Not only will homes and businesses, as well as public infrastructure, need to be rebuilt quickly, but in many cases, the expenses of such jobs will challenge contractors to do more with less.

During the Colorado floods of 2013, an estimated 37,000 gallons of oil spilled into the Front Range landscape. Dealing with the safe rebuilding of infrastructure (such as in these circumstances) may entail hiring individuals with specific kinds of engineering experience. Some individuals weren’t sure whether to bring these specialized subcontractors on as employees or maintain a subcontractor relationship during the rebuild.

As a local CPA– Steven J. Wicks & Associates, PC has lived through this demand increase, and seen the seasonality trends that have developed in the construction industry in Fort Collins & Northern Colorado. With our specialized insight, we know how to better protect your business during demand changes while maintaining your projections.

Laying the Right Foundation with Accounting Firms for Construction Contractors in Fort Collins

Many people who are finishing training programs or apprenticeships desire to start their own companies, but only a handful of those people will go on to be successful. While the demand for these services will continue to be high, it’s important to lay the right foundation, so you can stand apart from the competition.

Each industry has its own special rules and regulations, and different daily operations, so it’s always best to find an accountant who specializes in your field and knows your local regulations. Knowing that you are looking for an accounting firm in Fort Collins that specializes in construction contractors can help the process of narrowing down your options, and reaching out to a firm or two can make the decision easy.

Find A Reliable Accounting Firm Specializing in Construction Industry for Your Construction Business in Fort Collins

The construction business comes with many different and unique accounting structures. If you run a construction or contracting company, you’ll need an accountant that understands the legal loopholes involved with this type of business.

Steven J. Wick & Associates P.C. provides customized accounting solutions for construction and contracting companies in or near Fort Collins. You should feel heard and understood by your CPA, as they will become a valued member of your company team. Whether you need someone to do your bookwork or just figure out a tricky tax situation, we can help. Call us today to book a consultation with one of our construction and contracting accounting experts!

Subcontractor

If you have a career in the skilled trades, you’re no stranger to hard work. You use your tools, your hands, and your know-how to get the job done, sometimes working 12-hour days or scrambling to make tight deadlines. As opportunities grow, so is the financial complexity in keeping your business running. That’s why specialized accounting for construction contractors in Fort Collins isn’t just beneficial—it’s essential for sustainable growth and profitability.

Why Do Many Contractors Struggle with Accounting?

Often, tradespeople, construction workers, and contractors must juggle many tasks, clients, and paperwork to keep things running smoothly. You either put in more hours to do it yourself or rely on a receptionist or family member to manage their books.

Getting an accountant that understands the construction and construction subcontracting industry can be the difference between success and failure as a company.

However, taking on this complex task is stressful for everyone involved. More importantly, it can result in errors and other mishaps, some of which are serious and may damage the business. When you’re running to and from the job site or on call for residential emergencies, you don’t have the time or energy to make sure your bookkeeping is immaculate.

You shouldn’t have to endure the stress and take this massive risk! Unlike other industries, the construction industry involves a lot of different accounting situations that some accountants might not be familiar with. Hiring a qualified CPA that is familiar with skilled trades and related industries is one of the best business investments you can make.

With professional help, you can rest easily knowing that your books are clean and balanced, your payroll is handled on time, your bills can get paid efficiently, and you are good to go come tax time. And at SJ Wick, we understand the bookkeeping and accounting that go into construction contractors in Fort Collins.

Delegate Your Accounting Tasks and Focus on Growing Your Construction Business

If you’re great at fixing sinks or laying bricks, there’s no reason that you should also be great at accounting, too. Don’t try to do it all and end up burning yourself out. Stick with what you love, and delegate your important business tasks to third-party professionals.

When you hand off those bookkeeping headaches and tax filing nightmares to the experts, you free yourself up to focus on what you actually started your business for—wowing your clients with quality craftsmanship and building your construction business. Look for Fort Collins accounting firms specializing in the contractor and construction industry, so you know you’ll be in good hands.

What a Construction Accountant in Fort Collins Can Actually Do for You

Once you’ve laid the groundwork for your business, you must ensure your finances are equally well-prepared. For instance, there are hiring contracts to consider when it comes to a construction company. Making sure that your bookwork is prepared and maintained properly can mean the difference between keeping your employees happy and not.

A construction accounting professional will identify cost savings loopholes, assist with tax filing, and improve your company’s bottom line. Experienced accountants provide your business with competitive advantages through construction contractor tax savings strategy to thrive in Fort Collins.

Essential Accounting Services to Help Fort Collins Construction Contractors Succeed

Let’s face it—the construction industry needs a special kind of financial management that even regular accountants often don’t quite get. If you’re running a construction business in Fort Collins, here are some accounting services that can really make a difference to your success.

Job Costing and Project Profitability Tracking

In most cases, your profits aren’t measured quarterly like other businesses—they’re measured project by project. That’s why having specialized construction accounting in Fort Collins is so important. The right accounting partner will give you detailed job costing that tracks every dollar against your estimates, giving you a real-time view of how profitable each project actually is.

What makes job costing so crucial for your construction business? It’s all these moving parts:

- Your direct labor costs with proper burden allocation

- How much material you’re using and wasting

- How efficiently you’re using your equipment

- How much your subcontractors are costing you

- Financial impact when change orders come in

Track these details will help you spot patterns, such as which neighborhoods, project types, or crews are making you the most money. This helps you make smarter decisions about which jobs to bid on next.

Construction-Specific Cash Flow Management

Colorado’s construction season has its own rhythm. With busy building months followed by winter slowdowns, Fort Collins contractors face real challenges keeping cash flowing while also keeping your workforce intact.

An accounting team expert can guide you on how to manage cash flow for construction projects. They can also create cash flow projections that account for seasonal factors specific to Northern Colorado. This means you’ll be better prepared to keep money in the bank even during those predictably slow periods.

Financial Statements Optimized for Bonding and Lending

For construction contractors, financial statements have more uses than just for accounting and filing taxes in Fort Collins. These documents can also help your business in securing bonds, lines of credit, and project financing.

A good CPA may also act as a vital contact between your growing business, and banks or loan lenders. Especially within the construction industry, loans can become necessary when purchasing large or expensive equipment.

Some examples of specialized construction financial reporting include:

- WIP (Work-In-Progress) schedules that demonstrate project management capability

- Overhead allocation, risk management, job estimates, and special insurance or worker’s compensation

- Financial ratio analysis focused on benchmarks that matter to construction lenders

- Over/under billings analysis that signals proper project management

In essence, your accountant should be experienced working with construction companies and should have a good sense of the industry. A qualified accountant for construction contractors in Fort Collins will allow you to stay ahead of the game and ensure that all is running smoothly, so you can continue to focus on making your customers happy.

Mistakes Construction Contractors Often Make in Their Accounting

Did you know some of your “accounting” practices could actually be a big mistake? Check out some common mistakes construction contractors make:

- Using inconsistent files and poorly structured accounts: Many contractors create separate files for each project or job, then use an item list and chart of accounts that don’t accurately match the needs/expenses of their business. Creating custom item lists and charts of accounts may take some training, but it will enable business owners to track expenses and supplies more accurately.

- Mishandling vendor credits and customer payments: Failing to properly receive vendor credits against a bill or receiving payments from customers incorrectly can lead to messy financial records and costly errors.

- Not reconciling bank and credit card accounts: Construction business owners often fail to reconcile bank and credit card accounts, especially when using software like QuickBooks. Without regular reconciliation, discrepancies can go unnoticed for too long. So it is well worth asking for help from an accountant to understand how to perform this operation.

Do I Really Need a Construction-Specific Accounting Firm? 5 Reasons to Hire an Expert Accountant for Construction Contractors in Fort Collins

For those who work in skilled trades, like electricians, painters, and contractors, it’s worth seeking out an accountant who can speak your language. Here are three reasons why you should work with a CPA who understands your industry:

1. They understand the lingo

Each area of the skilled trades has its jargon, and it’s incredibly useful to work with someone who gets it. You want an accountant who knows your terms and expectations of your particular field, and who doesn’t need an explanation every time you talk about your job. This will help your interactions be smooth and hassle-free, and make you feel like you really have someone in your corner when you need them.

2. They aren’t intimidated by the paperwork

Owning and operating a small business isn’t easy, especially one that involves multiple clients, subcontractors, and suppliers. This is the normal way of things for electricians, roofers, and other construction workers, so it’s great to have a CPA who knows exactly how to file and track expense and revenue accounts.

3. They’re expert in handling tax season

For entrepreneurs and solo contractors, tax time can be a giant headache. But with the right accountant on board, your returns will be filled out correctly, and every aspect of your business for the past year will be accounted for. If you are intimidated by the tax process for small businesses, let a CPA handle the filing for you, so you know you will get the maximum return possible, and stay in compliance with state and federal laws.

Let Construction Accountants Help You Maximize Tax and Travel Deductions

There’s a lot of tax deductions that construction companies miss out on simply because nobody told them these opportunities exist. Think about all those business expenses you rack up—tools, driving around town, license fees, trade association dues—these are all potential tax deductions that can really add up. Just one catch: you can’t deduct anything a client paid you back for.

Going from jobsite to jobsite puts serious miles on your truck, but this another area where deductions can make a real impact. Tracking insurance, gas money, mileage, and even how much your vehicle depreciates may lead to significant tax savings.

It takes a skilled eye—and experience working with companies like yours—to navigate these tax rules and uncover every dollar you’re entitled to. Don’t give away more money than you have to. With the right accountant, you could put more of it back into your business.

4. They can keep your cash flow straight between contracts and services

There are also hiring contracts to consider when it comes to a construction company. Whether you are a painter or a plumber, making sure that your bookwork is prepared and maintained properly can mean the difference between keeping your employees happy and not.

5. They Help You Classify Workers Correctly

For the most part, construction work in Colorado is seasonal and requires seasonal or temporary labor. Since the construction industry often relies on subcontractors and independent contractors, as well as a dedicated crew, this is a key piece of tax filings.

As a general contractor, you may be tempted to rely on contract labor to avoid the tax burden. You may also have permanent staff, such as administrative staff or even some laborers, and it is important to classify these employees appropriately.

Misclassifying employees to avoid taxes is considered worker fraud by the IRS, even if the mistake is made in an attempt to simplify your finances. Managerial accounting support can help you determine the right way to deal with permanent and/or temporary workers.

An accountant will help you keep clean records and advise you on how to:

- Properly distinguish between contractors and employees

- File the correct forms (1099s vs W-2s)

- Avoid penalties related to misclassification

This step alone could save you from major compliance headaches. Make sure that your employees are classified correctly, and that your payroll accounts for all third parties, even the one specialist you called in for one job.

Working with a Local Accountant Means Specialized Insight into the Construction Business

Colorado is a small business-friendly state, and we have thousands of independently-owned companies here. One of the most vital industries is the skilled trades—plumbers, electricians, HVAC specialists, and other contractors—that provide highly valuable services for homes and businesses across the region.

The state’s construction industry is on a strong upward trajectory, with the Colorado Department of Labor and Employment projecting a 26% growth between 2020 and 2030. It’s also expected to open the door to more lucrative career opportunities, especially in specialty trades, where employment is forecasted to grow by 28%.

The weather and geographic area that Fort Collins lies in has its own challenges and opportunities for those in Northern Colorado. Only a CPA local to the area would be aware of and be able to incorporate into their projections.

Fluctuating Demand: An Example of Increased Construction Demand in Northern Colorado

In September 2013, much of Northern Colorado was deeply affected by flooding. It was estimated that nearly 1,800 homes were destroyed. The cost of rebuilding was anticipated to be astronomical, and construction contractors were put to the test on a variety of fronts. Not only will homes and businesses, as well as public infrastructure, need to be rebuilt quickly, but in many cases, the expenses of such jobs will challenge contractors to do more with less.

During the Colorado floods of 2013, an estimated 37,000 gallons of oil spilled into the Front Range landscape. Dealing with the safe rebuilding of infrastructure (such as in these circumstances) may entail hiring individuals with specific kinds of engineering experience. Some individuals weren’t sure whether to bring these specialized subcontractors on as employees or maintain a subcontractor relationship during the rebuild.

As a local CPA– Steven J. Wicks & Associates, PC has lived through this demand increase, and seen the seasonality trends that have developed in the construction industry in Fort Collins & Northern Colorado. With our specialized insight, we know how to better protect your business during demand changes while maintaining your projections.

Laying the Right Foundation with Accounting Firms for Construction Contractors in Fort Collins

Many people who are finishing training programs or apprenticeships desire to start their own companies, but only a handful of those people will go on to be successful. While the demand for these services will continue to be high, it’s important to lay the right foundation, so you can stand apart from the competition.

Each industry has its own special rules and regulations, and different daily operations, so it’s always best to find an accountant who specializes in your field and knows your local regulations. Knowing that you are looking for an accounting firm in Fort Collins that specializes in construction contractors can help the process of narrowing down your options, and reaching out to a firm or two can make the decision easy.

Find A Reliable Accounting Firm Specializing in Construction Industry for Your Construction Business in Fort Collins

The construction business comes with many different and unique accounting structures. If you run a construction or contracting company, you’ll need an accountant that understands the legal loopholes involved with this type of business.

Steven J. Wick & Associates P.C. provides customized accounting solutions for construction and contracting companies in or near Fort Collins. You should feel heard and understood by your CPA, as they will become a valued member of your company team. Whether you need someone to do your bookwork or just figure out a tricky tax situation, we can help. Call us today to book a consultation with one of our construction and contracting accounting experts!